In the ever-evolving landscape of digital finance, the quest for security has never been more paramount. As cryptocurrencies gain traction, both as assets and as a means of transaction, the need for reliable storage solutions has surged. Enter the world of crypto wallets—the digital vaults that safeguard your hard-earned investments. With a plethora of options available, ranging from user-kind mobile apps to elegant hardware devices, navigating this terrain can feel overwhelming. In this article, we delve into the best crypto wallets tailored for secure investments, exploring their features, benefits, and the unique levels of security they offer. Weather you’re a seasoned investor or just beginning your journey into the crypto market, understanding the right wallet can make all the difference in protecting your financial future. Join us as we unpack the essentials of selecting a wallet that not only meets your investment needs but also fortifies your digital assets against the uncertainties of this dynamic market.

Exploring the Landscape of Crypto Wallets for Safeguarding Your Assets

In the fast-evolving world of cryptocurrency,the importance of a reliable wallet cannot be overstated. A crypto wallet serves as a digital vault, safeguarding your investments against theft or loss. When choosing one, it’s crucial to consider factors such as security features, ease of use, and supported cryptocurrencies.Many wallets incorporate advanced security protocols, including end-to-end encryption and multi-factor authentication, which add layers of protection to your assets.

There are generally three types of wallets available to crypto investors:

- Hardware Wallets: These are physical devices that provide offline storage for your cryptocurrencies. With features like robust encryption and isolation from potential online threats, they are often regarded as the most secure option.

- Software Wallets: Available as desktop or mobile applications, software wallets allow for convenient access to your assets. While they may be more vulnerable to hacking, many leading applications offer enhanced security measures.

- Paper Wallets: A less common option,paper wallets involve printing your public and private keys on a physical medium. This completely offline method eliminates online threats but demands careful handling to avoid physical loss or damage.

To aid in your selection, consider this comparison table highlighting the key features of popular wallets:

| Wallet Type | Security Level | User-Friendly | Best For |

|---|---|---|---|

| Hardware | High | Moderate | Long-term storage |

| Software | Moderate | High | Active trading |

| Paper | Very High | Low | Cold storage |

As you navigate the myriad of options available for crypto wallets, weighing the benefits and risks associated with each type is paramount. Ultimately, the right wallet for you will depend on your investment strategy, trading frequency, and personal security preferences. With careful consideration and thorough research, you can ensure that your crypto assets remain safe and accessible, regardless of market fluctuations.

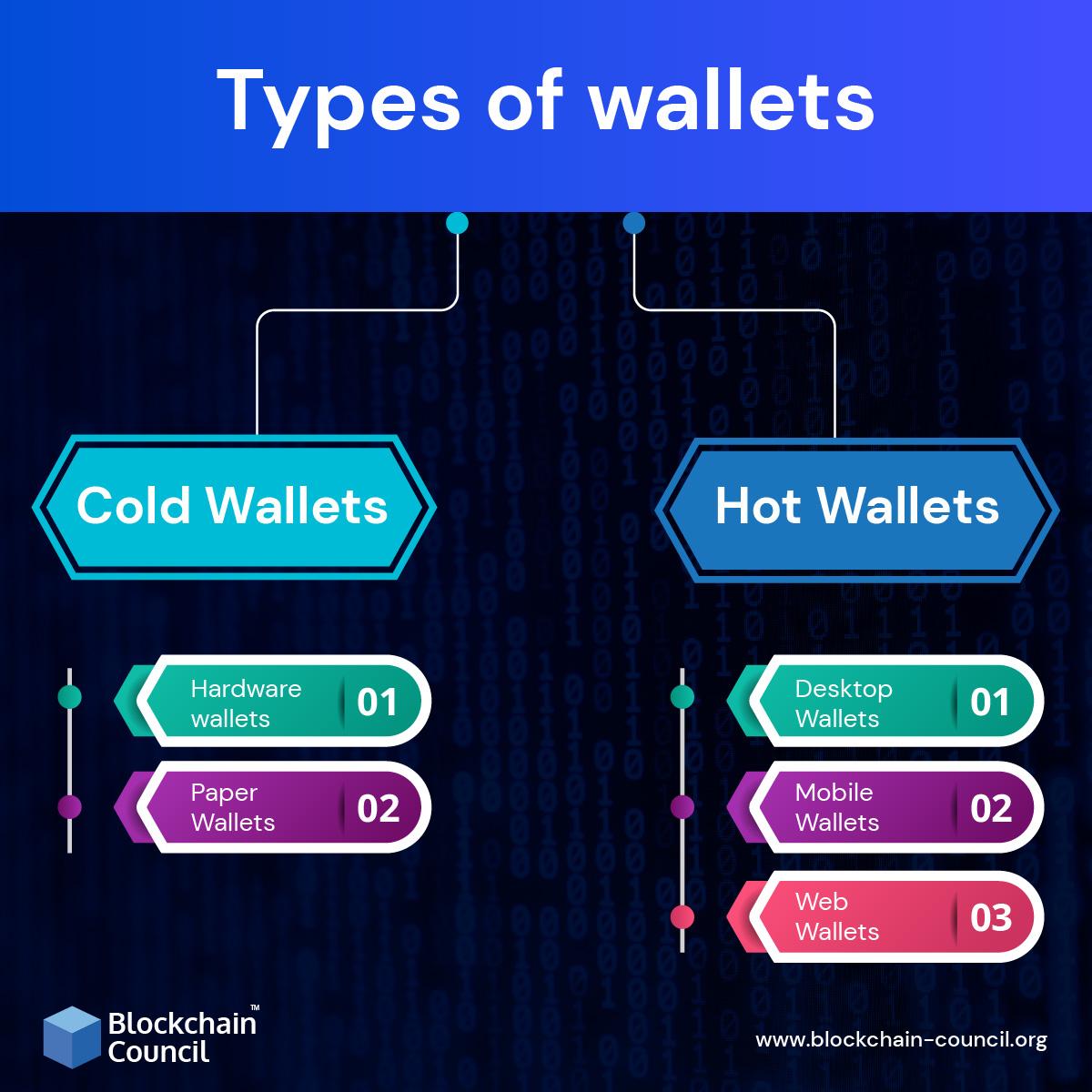

Comparative Analysis of Hot Wallets Versus Cold wallets

When evaluating cryptocurrency storage solutions, users often find themselves choosing between hot wallets and cold wallets. Hot wallets, connected to the internet, provide greater convenience and accessibility, making them ideal for traders requiring rapid transactions. Due to their online nature, though, they expose users to greater risks from cyber threats. Examples of hot wallets include mobile apps, desktop wallets, and web-based platforms. While they may offer user-friendly interfaces, they maintain vulnerabilities to hacking and phishing attacks.

On the other hand, cold wallets offer a higher level of security by storing cryptocurrencies offline. These wallets,which include hardware wallets and paper wallets,are less susceptible to online threats,making them a solid choice for long-term investors.Users can safeguard their assets even in the event of a compromised computer, as cold wallets keep keys away from internet exposure. However, the trade-off lies in their accessibility; transactions can be cumbersome and require additional steps, which makes them less suitable for frequent trading activities.

| Feature | Hot Wallets | Cold Wallets |

|---|---|---|

| Accessibility | High | Low |

| Security Level | Medium | High |

| User-Friendliness | Easy | Complex |

| Best For | Traders | long-term Holders |

Choosing between hot and cold wallets largely depends on your investment strategy. For those who frequently trade and require immediate access to their assets, hot wallets present a practical solution, despite their inherent risks. Conversely, if you are looking to store your cryptocurrencies securely over an extended period, cold wallets serve as the safer alternative.Ultimately, diversifying your storage methods may also be a beneficial strategy, allowing you to balance convenience and security according to your needs.

Features to Look For: Key Factors in Choosing the Right Wallet

When selecting a cryptocurrency wallet, it’s essential to consider multiple factors that cater to your specific needs and investment strategy. A user-friendly interface allows both beginners and experienced crypto enthusiasts to navigate seamlessly. look for wallets that offer an intuitive design, making it easy to send, receive, and manage your digital assets without hassle.Additionally, consider mobile compatibility, as having access to your wallet on-the-go enhances convenience and adaptability in managing your investments.

Security measures cannot be overlooked in the quest for the ideal wallet. Evaluate the following aspects:

- Private Key Control: Choose wallets that give you complete control of your private keys, meaning you are the sole custodian of your funds.

- Two-Factor Authentication (2FA): This adds an extra layer of protection, requiring a second form of verification alongside your password.

- Backup Options: Ensure the wallet provides reliable backup and recovery options to protect your assets in case of device loss or failure.

Lastly, consider the wallet’s supported cryptocurrencies. Not all wallets support every digital currency; thus, it’s crucial to select one that accommodates your preferred coins and tokens. Moreover, keep an eye on the wallet’s transaction fees to avoid excessive costs over time.To help visualize this, refer to the table below:

| Wallet Type | Supported Coins | Average Transaction Fee |

|---|---|---|

| Hardware Wallet | BTC, ETH, LTC, and more | Low ($0.1-$1) |

| Software Wallet | All major coins | Varies (0.5%-5%) |

| Mobile Wallet | BTC, ETH, NFTs | Low to medium ($0.1-$2) |

Top Recommendations: Wallets That Excel in Security and Usability

When it comes to safeguarding your digital assets, the right wallet can make all the difference. Several options stand out for their robust security features combined with user-friendly interfaces. Whether you’re a seasoned investor or just starting, you can choose from the following top-tier wallets that prioritize both security and usability:

- Ledger Nano X: This hardware wallet offers state-of-the-art security through its secure chip and Bluetooth connectivity. It supports multiple cryptocurrencies and is accessible via an intuitive mobile app.

- Trezor Model T: Known for its sleek design and touch screen, this wallet provides exceptional private key security and is compatible with numerous cryptocurrencies, enhancing user experience.

- Electrum: A software wallet that combines speed and functionality, Electrum is lightweight and supports advanced features like hardware wallet integration, making it ideal for enthusiasts.

When evaluating these wallets, certain characteristics consistently emerge across the board. Security protocols such as two-factor authentication, seed phrase protection, and regular firmware updates are critical in providing peace of mind. The following table highlights key features of these wallets, comparing their security measures and ease of use:

| Wallet | Security Features | Usability |

|---|---|---|

| Ledger Nano X | secure chip, bluetooth, 2FA | Mobile app, multi-currency support |

| Trezor Model T | Touchscreen, recovery seed, password manager | User-friendly interface |

| Electrum | two-factor authentication, encryption | Fast setup, hardware wallet support |

Selecting the right wallet is essential for anyone serious about protecting their cryptocurrency investments. The wallets mentioned above not only excel in security measures,but also in delivering an accessible and effective user experience.Investing time to evaluate your options will ensure you find a wallet that complements your investment strategy while keeping your assets safe.

Q&A

Q&A: The Best Crypto Wallets for Secure Investments

Q1: What is a crypto wallet, and why do I need one for my investments?

A: A crypto wallet is a digital tool that allows you to store, send, and receive cryptocurrencies like Bitcoin or Ethereum securely. Just like a conventional wallet keeps your cash safe, a crypto wallet protects your digital assets from theft, loss, and unauthorized access. whether you’re a budding investor or a seasoned trader, having a reliable crypto wallet is crucial for the safe management of your investments.

Q2: What are the different types of crypto wallets?

A: Crypto wallets generally fall into two main categories: hot wallets and cold wallets.Hot wallets are connected to the internet and allow for quick access and transactions, making them perfect for active traders. cold wallets, conversely, are offline storage solutions—like hardware wallets or paper wallets—that offer enhanced security, ideal for long-term investors who want to safeguard their assets from online threats.

Q3: What should I look for when choosing a crypto wallet?

A: When choosing a crypto wallet, consider key factors such as security features (like two-factor authentication or multisignature options), user-friendliness, compatibility with various cryptocurrencies, and backup options. Evaluate the reputation of the wallet provider and check reviews for reliability. Furthermore, think about your investment style: if you’re active, a hot wallet might suffice; if you want to hold long-term, a cold wallet could be the way to go.

Q4: are there any trusted crypto wallets you recommend?

A: Certainly! Some of the highly regarded crypto wallets include:

- Ledger Nano X – A leading hardware wallet known for its robust security features and Bluetooth capability for easy mobile use.

- Trezor Model T - Another popular hardware wallet that offers a user-friendly interface, with strong security and support for many cryptocurrencies.

- Exodus – A software wallet that offers a stunning interface and is ideal for new users, even though it may lack some advanced security features.

- Coinbase Wallet - A secure mobile wallet that integrates seamlessly with the Coinbase exchange, making it accessible for beginners.

- Atomic Wallet - A versatile software wallet allowing you to manage a multitude of cryptocurrencies all in one place.

Q5: Can I use multiple wallets for different cryptocurrencies?

A: Absolutely! In fact, many investors find it beneficial to use multiple wallets. This strategy can enhance security and organization—allowing you to keep some assets in cold storage for long-term investment while using hot wallets for daily transactions or trading. It’s all about finding the right balance that suits your lifestyle and investment objectives.

Q6: How do I ensure that my crypto wallet remains secure?

A: Keeping your crypto wallet secure involves implementing several best practices:

- Regularly update your software and firmware to combat vulnerabilities.

- Use strong, unique passwords and consider a password manager.

- Enable two-factor authentication wherever possible to add an extra layer of security.

- Always back up your wallet and keep those backups in a safe location, preferably offline.

- Be cautious of phishing attempts and avoid sharing your private keys with anyone.

Q7: What are the common pitfalls to avoid when using crypto wallets?

A: Be mindful of these common pitfalls:

- Never share your private keys or recovery phrases with anyone.

- Avoid using public Wi-Fi networks when accessing your crypto wallet.

- Don’t ignore wallet updates and security notifications—stay proactive about your security.

- Lastly,be wary of scams and only download wallets from reputable sources.

Q8: Is it too late to invest in cryptocurrency now?

A: While the crypto market can be volatile, it’s never too late to start investing, provided you do your research and understand the risks involved. many triumphant investors have entered the market at various stages. Just remember to choose a secure wallet and adopt a strategy that aligns with your financial goals and risk tolerance.

This Q&A covers essential aspects of crypto wallets, ensuring you have the knowledge necessary to make informed decisions about securing your cryptocurrency investments. Happy investing!

Concluding Remarks

In the ever-evolving landscape of cryptocurrency, securing your investments is paramount. As we conclude our exploration of the best crypto wallets, it’s clear that choosing the right storage solution is not just a matter of convenience—it’s a crucial step towards safeguarding your digital assets. Whether you opt for a hardware wallet’s robust offline protection, the flexibility of software options, or the integrated features of mobile wallets, each choice has its own merits tailored to different investment strategies and risk tolerances.

As you embark on your cryptocurrency journey, remember that a well-protected asset is a confident one. Take the time to assess your needs, research the functionalities of each wallet, and prioritize security measures that resonate with your investment philosophy. In this decentralized world,knowledge is your ally,and preparedness is your shield. With the right wallet in hand, you can navigate the thrilling realm of cryptocurrencies with greater peace of mind. Here’s to informed decisions and secure investments in the digital age!