In an ever-evolving digital landscape, the allure of cryptocurrency has captivated investors, prompting many to seek the secret formula for long-term success in this volatile market. Unlike customary assets, the realm of digital currencies offers both unparalleled opportunities and substantial risks, making strategic navigation essential. As we embark on a journey through the intricacies of crypto investment strategies designed for sustained gains, we will explore diverse approaches that can empower investors to build resilience against market fluctuations and harness the potential of blockchain technology. Whether you’re a seasoned trader or a curious newcomer, understanding these strategies can help illuminate the path toward a prosperous future in the world of cryptocurrencies. Join us as we uncover the tools and tactics that could transform your crypto ambitions into reality.

Understanding market Trends and Cycles in Cryptocurrency

In the rapidly evolving world of cryptocurrency, understanding the ebb and flow of market trends and cycles is crucial for investors seeking lasting growth. Unlike traditional markets, the crypto space is marked by high volatility and swift price movements, which often follow discernible patterns. Recognizing these patterns can empower investors to make informed decisions, allowing them to ride the waves of market cycles rather than being swept away by sudden downturns or dramatic surges. key factors influencing these fluctuations include:

- Market Sentiment: The collective mood of investors, frequently enough swayed by news, social media, and critically important events.

- Technological Developments: innovations in blockchain technology can lead to price surges or declines.

- Regulatory Changes: Legal frameworks and government regulations can dramatically impact market confidence.

Investors shoudl also familiarize themselves with past data to identify previous cycles within the market. Analyzing past bull and bear markets can reveal vital insights about potential future movements. Utilizing tools such as market cap charts, trading volume statistics, and sentiment analysis can aid in forecasting future trends. below is a simplified table of historical BTC price cycles for better contextual understanding:

| Cycle Phase | Start Date | End Date | Max Price (USD) |

|---|---|---|---|

| bull Market | 2017-01-01 | 2017-12-31 | 19,783 |

| Bear Market | 2018-01-01 | 2019-12-31 | 3,194 |

| Recovery | 2020-01-01 | 2021-12-31 | 69,000 |

By leveraging these insights into market behavior, investors can develop robust strategies that align with their long-term goals. For instance, employing dollar-cost averaging during downturns allows investors to accumulate assets at lower prices, while identifying breakout trends during bull markets can maximize gains. Ultimately, a deep understanding of market trends will enhance an investor’s ability to navigate the complex and often tumultuous waters of cryptocurrency investment.

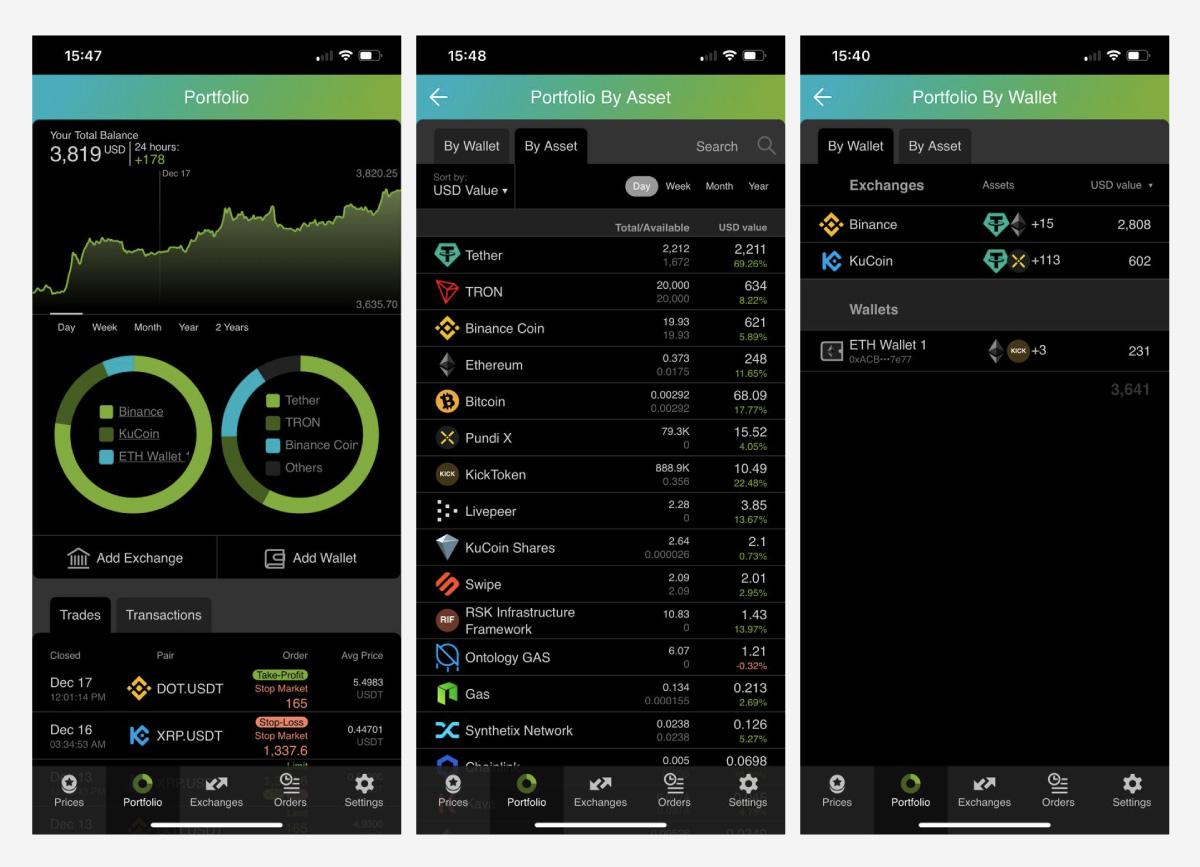

Diversifying Your Crypto Portfolio for Stability and Growth

Investing in cryptocurrency can be both exhilarating and daunting, particularly given the market’s inherent volatility. A prudent approach involves broadening your investment horizon by incorporating various cryptocurrencies into your portfolio. This strategy not only mitigates risks but also positions you to capitalize on unexpected market movements. Consider segmented allocations that might include established players, emerging coins, and stablecoins, which can provide a balanced mix reflecting various sectors of the market.

When selecting assets, take into account factors such as market capitalization, technological differentiation, and community support. This approach invites diversification across different categories, such as:

- Large-Cap Investments: Established cryptocurrencies like Bitcoin and Ethereum.

- mid-Cap Assets: Up-and-coming projects with significant growth potential.

- Stablecoins: Coins like USDT or USDC that offer stability in turbulent times.

By doing so, you create a resilient investment landscape where the growth of one set of assets can offset potential downturns in another.

To further dissect your approach, maintain a keen eye on market trends and adjust your allocations accordingly. Utilize a table to monitor key assets and their performance, ensuring your decisions are data-driven. Below is a sample table structure that can help with tracking your diverse investments:

| Cryptocurrency | Market Cap | Performance (1 Month) | Risk Level |

|---|---|---|---|

| Bitcoin (BTC) | $850 Billion | +5% | Low |

| Ethereum (ETH) | $400 Billion | +10% | Moderate |

| Cardano (ADA) | $50 Billion | +15% | High |

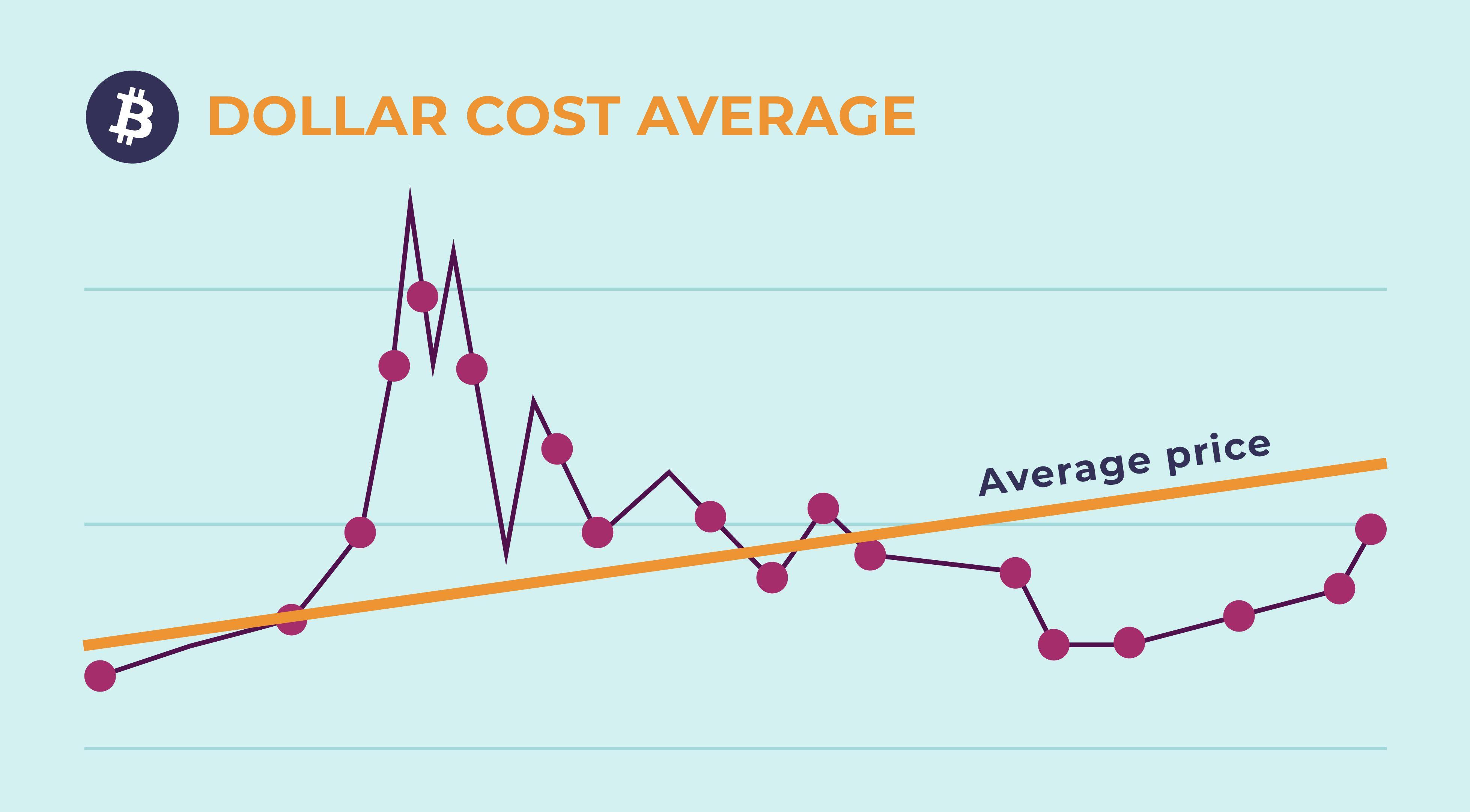

Implementing Dollar-Cost Averaging for Risk Mitigation

One of the most effective strategies for mitigating risk in the unpredictable world of cryptocurrency is to adopt a structured investment approach known as dollar-cost averaging (DCA). this method involves allocating a fixed amount of funds to purchase a specific cryptocurrency at regular intervals, regardless of its price.By doing so, investors can avoid the pitfalls of trying to time the market and reduce the impact of volatility on their overall investment.

Implementing dollar-cost averaging comes with several advantages:

- Consistent Investment: Regularly investing a set amount fosters discipline and reduces emotional decision-making.

- Price Averaging: By buying at different price points, the average cost per unit can be lower than if one were to make a lump-sum investment at a high point.

- Market Fluctuation Shield: This strategy helps cushion against sudden price drops, as more units are purchased when prices are lower.

To illustrate how effective DCA can be, consider the following table representing hypothetical investments in a cryptocurrency over a six-month period:

| Month | investment ($) | Price per coin ($) | Coins Purchased |

|---|---|---|---|

| 1 | 100 | 10 | 10 |

| 2 | 100 | 5 | 20 |

| 3 | 100 | 8 | 12.5 |

| 4 | 100 | 12 | 8.33 |

| 5 | 100 | 15 | 6.67 |

| 6 | 100 | 20 | 5 |

In the above example, despite fluctuations in the price of the cryptocurrency, the investor accumulates a total of 72.5 coins by consistently investing $100 monthly. such a strategy illustrates how dollar-cost averaging not only can lower the average cost per coin but also encourages a long-term outlook essential for triumphant cryptocurrency investment.

The importance of Research and Continuous Learning in Crypto Investments

In a rapidly evolving landscape like cryptocurrency, staying informed is an essential part of successful investing.Continuous research enables investors to identify emerging trends, understand market sentiments, and adapt their strategies accordingly. the crypto market is influenced by various factors, including technological advancements, regulatory changes, and even social dynamics. By immersing oneself in this weighty data,investors can make educated decisions that align with their long-term goals.

Equipped with the right knowledge, investors can create a robust investment strategy that includes a diverse portfolio. This may involve exploring different types of cryptocurrencies, such as:

- Bitcoin and altcoins: Assessing the market cap and potential for growth.

- Staking and yield farming: Platforms offering returns for holding or lending assets.

- Decentralized finance (DeFi): investing in projects reshaping traditional financial services.

Different investment methods cater to various risk tolerances and financial goals, allowing investors to tailor their portfolios for maximum long-term gains.

To facilitate effective decision-making,it’s imperative to analyze historical data and project future movements. Utilizing tools such as price charts and market analysis can provide critical insights into potential growth trajectories. A simple comparison of different coins can illustrate their performance, such as:

| Cryptocurrency | Market Cap | Year-to-date Growth |

|---|---|---|

| Bitcoin (BTC) | $850 Billion | 52% |

| Ethereum (ETH) | $400 Billion | 78% |

| Cardano (ADA) | $30 Billion | 100% |

through diligent research and an appetite for continuous learning, investors can navigate the complexities of the crypto market, mitigating risks and enhancing their potential for success. By fostering a culture of inquiry and analysis, one can not only understand the present landscape but also anticipate its future, thereby sculpting a comprehensive and profitable investment strategy.

Q&A

Q&A: Crypto Investment Strategies for Long-Term Gains

Q1: what is the primary appeal of investing in cryptocurrencies for the long term?

A1: The allure of long-term crypto investment lies in its potential for substantial returns. Cryptocurrencies are often seen as digital gold, providing a hedge against inflation and traditional market fluctuations. Additionally, with the growing acceptance of blockchain technology, investors are increasingly optimistic about the long-term viability and mainstream adoption of various cryptocurrencies.

Q2: How should a newcomer approach investing in cryptocurrencies for the long haul?

A2: For beginners, the best approach is to start with thorough research and education. Understanding blockchain technology and the various cryptocurrencies available will give investors a solid foundation.Consider establishing a diversified portfolio by investing in a mix of established coins like Bitcoin and Ethereum, while also exploring promising altcoins. it’s wise to invest only what you can afford to loose and to adopt a buy-and-hold strategy to weather the market’s ups and downs.

Q3: What are some commonly recommended strategies for long-term crypto investments?

A3: Several strategies can enhance long-term investment success:

- Dollar-Cost Averaging (DCA): This involves regularly buying a fixed dollar amount of cryptocurrency, reducing the impact of volatility.

- HODLing: A term derived from a misspelled forum post, it involves simply holding onto your assets through market fluctuations, betting on long-term growth.

- Staking: Some cryptocurrencies allow you to earn rewards for holding your coins in a staking wallet, providing a way to generate passive income.

- Research and Rebalance: Regularly reviewing your portfolio and staying updated on market trends can help you adjust your investments as necessary.

Q4: How critically important is a secure storage solution for long-term crypto holders?

A4: security is paramount in the world of cryptocurrency. Long-term investors should opt for secure storage solutions such as hardware wallets, which keep your private keys offline and safe from hacks. Regularly updating your security practices and staying vigilant about phishing scams is essential to protect your investments over time.

Q5: What role does market sentiment play in the long-term crypto investment journey?

A5: Market sentiment can affect prices in the short term but should be viewed with a discerning eye by long-term investors. While it’s vital to stay informed about market trends and news, foundationally, the focus should be on the underlying technology and the long-term potential of your investments. Avoid panic selling during downturns; instead, trust your research and investment thesis.

Q6: How can investors navigate the regulatory landscape surrounding cryptocurrencies?

A6: Staying informed about regulations is crucial, as they can significantly impact the market and your investments. Following reputable news sources, joining crypto communities, and networking with educated investors can definitely help you stay updated. Furthermore, understanding the regulatory surroundings in your country can guide your investment decisions and ensure compliance.

Q7: Are ther specific metrics or indicators that long-term investors should monitor?

A7: Indeed! Long-term investors should keep an eye on metrics such as market capitalization,transaction volumes,active addresses,and network growth. Additionally, monitoring the progress roadmap of cryptocurrencies and understanding the team behind a project can provide insights into its potential longevity and success.

Q8: What final advice can you give to those considering long-term crypto investments?

A8: Patience and diligence are the keys to success in crypto investing. always invest based on careful analysis rather than hype or fear. Stay informed, adapt to evolving landscapes, and maintain a long-term perspective, focusing on the fundamental value of your investments. Diversification and risk management are vital, so remain flexible, and don’t be afraid to adjust your strategy as needed. Happy investing!

In Conclusion

As we navigate the ever-evolving landscape of cryptocurrency, it becomes increasingly clear that the journey toward long-term investment success is not simply about the coins we hold, but the strategies we embrace. By fostering a disciplined approach—balancing research, risk management, and regular portfolio assessments—you can position yourself not just as a participant in this digital revolution, but as a savvy investor prepared for the waves of volatility.

Remember, every great investor has weathered storms, learning from both triumphs and setbacks. As you set forth on your cryptocurrency investment journey,keep your eyes firmly on the horizon. Align your strategy with your financial goals, stay informed, and remain patient.The path may be riddled with uncertainties, but with perseverance and a well-crafted plan, the potential for long-term gains is within reach.

with the lessons shared in this article, consider your strategy as a living document—one that evolves with market trends, technological advancements, and your own growing knowledge. May your investments not just thrive but flourish, guiding you towards a future illuminated by the possibilities of the crypto world. Happy investing!