in the vast world of commercial transportation, the frequently enough-overlooked companion of every long-haul journey is insurance—specifically, high-risk truck insurance. For trucking companies and self-reliant operators, navigating the complexities of insurance can feel like traversing a winding road fraught with unexpected turns and potholes. Whether you’re hauling fragile cargo through treacherous weather or managing a fleet with a history of claims, understanding the cost implications and various factors that influence high-risk truck insurance is crucial. In this article, we’ll explore what to expect from different providers, unraveling the nuances of pricing structures, coverage options, and the unique considerations that come with high-risk classifications. By the end, you’ll be better equipped to steer through the insurance landscape and make informed decisions that safeguard your business while keeping your bottom line intact.

Understanding the Factors Influencing High-Risk Truck Insurance Rates

When it comes to determining the rates for high-risk truck insurance, several factors come into play that significantly impact the final cost. These factors include the driver’s history, which encompasses prior accidents, traffic violations, and claims made on previous policies. Insurers are keen to assess the likelihood of future claims based on a driver’s past behaviour,meaning that a clean driving record can lead to lower rates,while a history of infractions can escalate costs. Additionally, the type of cargo being transported can influence insurance prices; transporting hazardous materials generally incurs higher premiums due to the increased risk associated with potential accidents or spills.

Moreover, the vehicle’s age and condition must also be considered, as newer trucks equipped with advanced safety features may qualify for discounts, while older models lacking these improvements can attract higher rates. Geographic location plays a crucial role as well; urban areas with high traffic congestion tend to have higher accident rates,leading to increased premiums. Other significant considerations include the business operations of the trucking company itself,such as claims history and safety programs in place,all of which serve as indicators of risk and can ultimately shape the cost of high-risk truck insurance.

Comparing Coverage Options: What Providers Offer for High-Risk drivers

When navigating the realm of high-risk driver insurance, understanding the coverage options available from various providers is crucial. Each provider has a unique approach to underwriting policies for high-risk individuals, impacting both coverage comprehensiveness and costs. Some common features offered by these insurers include:

- Higher Liability Limits: High-risk drivers frequently enough need higher liability limits to ensure adequate protection in case of an accident.

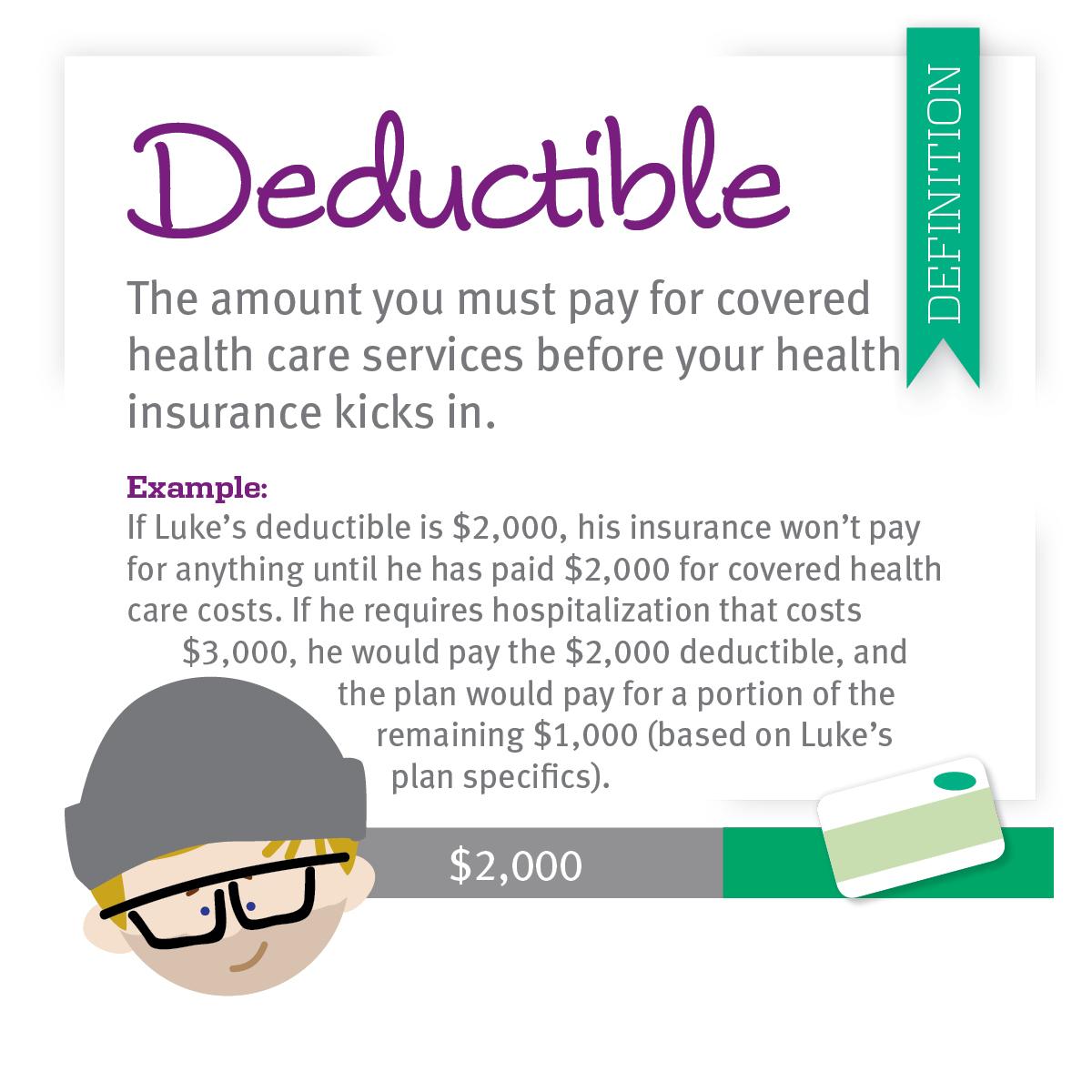

- Deductible Options: Adaptability in deductibles can allow drivers to tailor their coverage to fit their budget while managing potential out-of-pocket costs.

- 24/7 Roadside Assistance: Many providers offer emergency services which can be beneficial when driving under uncertain conditions.

- Specialized Coverage Add-Ons: Features like non-owned auto coverage or rental reimbursement can be included to enhance policy utility.

Moreover, the premium rates charged by providers can differ significantly based on their assessment of risk and operational models. To illustrate how these differences manifest, consider the following table that compares some of the top options for high-risk truck insurance:

| Provider | Average Premium | Key Features |

|---|---|---|

| Provider A | $3,500 | High liability limits, flexible deductibles |

| Provider B | $4,200 | Comprehensive roadside assistance, specialized add-ons |

| Provider C | $3,800 | Non-owned auto coverage, competitive pricing |

Navigating Deductibles and Premiums: Finding the Right Balance

When it comes to high-risk truck insurance, understanding the interplay between deductibles and premiums is crucial for securing the best coverage while managing costs. Deductibles represent the amount you’ll pay out of pocket before your insurance kicks in.High-risk insurers frequently enough present options with varying deductible levels, were higher deductibles can lead to lower premium costs. This trade-off requires careful consideration; a higher deductible means more financial obligation in the event of a claim, while a lower deductible may ensure more immediate assistance but at a heavier monthly cost. Truck owners must assess their financial situation and risk tolerance to strike the right balance.

Moreover, premiums are influenced by numerous factors, including the type of cargo transported, driving history, and vehicle safety features. Potential policyholders may find it helpful to compare rates across different providers to gauge how premiums and deductibles align.Here are some key points to consider while navigating these costs:

- Risk Assessment: Evaluate your driving history and traffic violations.

- Cargo Type: Certain loads may require more comprehensive coverage.

- Vehicle Safety: Features like anti-lock brakes can lower premiums.

- Provider Comparison: Use online tools to compare premium rates.

| Provider | Deductible Options | Average Premium |

|---|---|---|

| Provider A | $1,000 – $5,000 | $4,500/year |

| Provider B | $2,500 - $10,000 | $5,000/year |

| Provider C | $500 – $3,000 | $4,200/year |

tips for Lowering Your High-Risk Truck Insurance Costs

Lowering your high-risk truck insurance costs requires a strategic approach and an understanding of the factors that impact premiums. It’s essential to maintain a clean driving record.Even minor infractions can increase your risk profile and, consequently, your insurance costs. Consider taking a defensive driving course; many insurers offer discounts for completing such programs.Additionally, implementing safety features in your trucks can significantly reduce your premium. Examples include stability control systems, GPS tracking, and blind-spot detection, which not only improve safety but also make you an attractive option for insurers.

Another effective strategy is to reassess your coverage needs. Work with your agent to understand what is mandatory and what you might be over-insuring. By identifying unneeded add-ons, you can tailor your policy to suit your specific operations and reduce costs. Moreover, consider bundling policies with the same provider. Many companies provide discounts for insuring multiple vehicles or additional business insurance needs under one roof. Lastly, don’t hesitate to shop around and request quotes from different providers, as competition often leads to better pricing and tailored policies for high-risk drivers.

Q&A

Q&A: Cost of High-Risk Truck Insurance: What to Expect by Provider

Q: What exactly qualifies as high-risk truck insurance?

A: High-risk truck insurance is designed for commercial truck operators who present a greater likelihood of filing a claim based on several factors, including a history of accidents, traffic violations, or the type of freight being transported. Insurance companies classify certain drivers and operations as high-risk due to these risk factors, leading to higher premiums compared to those with a clean record.

Q: How do costs compare between different providers for high-risk truck insurance?

A: Costs can vary significantly among different providers. Each insurer assesses risk differently, factoring in driver history, vehicle type, and operational practices. Some may offer competitive rates to attract high-risk clients, while others maintain strict underwriting guidelines that lead to higher premiums. It’s essential to shop around and compare quotes from multiple insurers to find the best deal for your specific situation.

Q: What factors affect the cost of high-risk truck insurance?

A: Several key factors influence the cost,including:

- Driving History: Past violations and claims can lead to higher premiums.

- Type of Truck: The make and model can impact costs; larger,specialized trucks may incur more fees.

- Cargo Type: Transporting hazardous materials often results in higher premiums due to increased risk.

- Annual Mileage: Longer distances can equate to a greater risk of accidents, affecting overall costs.

- Location: Areas with high accident rates or theft can influence insurance pricing.

Q: Are there ways to reduce the cost of high-risk truck insurance?

A: Yes, there are several strategies to possibly lower your premiums:

- Improve Your Driving Record: Focus on safe driving to reduce points on your license.

- Bundling Policies: If you have other insurance needs, consider bundling to receive a discount.

- Safety training: Enroll in safety programs or training courses which some insurers recognize and may reward with lower rates.

- Higher Deductibles: Opting for a higher deductible can lower your premium, though you’ll need to budget for out-of-pocket costs in the event of a claim.

- Shop Around: Regularly comparing rates and negotiating with different providers can yield better pricing.

Q: Is high-risk truck insurance worth it for my business?

A: While high-risk truck insurance may come with elevated costs, it’s essential for mitigating financial risks in the event of an accident or claim. Depending on the nature of your business and the potential liabilities associated with operation, investing in high-risk coverage can protect your assets and ensure compliance with legal requirements. Ultimately, weighing the costs against potential risks will help determine if it’s a worthwhile investment.

Q: How can I find the right provider for my high-risk truck insurance needs?

A: start by researching providers who specialize in high-risk truck insurance. Look at reviews, customer testimonials, and claims processes to gauge service quality. Direct discussions with insurance agents can provide insights into coverage options and underwriting practices. Additionally, consider professional associations that may offer resources to connect you with reputable insurers tailored for your industry.

—

By understanding these aspects of high-risk truck insurance costs and provider offerings, you can make informed decisions that align with your business’s needs.

In Conclusion

As we’ve navigated the winding roads of high-risk truck insurance, it’s clear that understanding the costs associated with different providers is essential for making informed decisions. Each provider offers a unique blend of coverage options, pricing structures, and risk management strategies that cater to varying needs. Whether you’re a seasoned fleet manager or a new entrant in the trucking industry, being equipped with this knowledge empowers you to choose wisely.

As you prepare to hit the road, remember that the best insurance isn’t just about cost—it’s about ensuring peace of mind while you drive. We encourage you to explore your options, compare quotes, and consider industry insights to find the right coverage for your specific circumstances. After all, in the world of trucking, safety should always come first, and secure coverage is the compass that can guide you towards a safer and more profitable journey ahead. Safe travels!