In the ever-evolving landscape of cryptocurrency, the quest for financial growth is akin to a daring expedition thru uncharted waters. For many, the allure of digital assets promises not only thrilling potential returns but also the intoxicating possibility of transforming fortunes. Yet, as wiht any adventure, the journey into the crypto realm comes with its share of uncertainties and risks. To navigate this dynamic terrain successfully, one of the most prudent strategies is to build a diversified crypto portfolio. This approach not only mitigates risk but also positions investors to capitalize on diverse market opportunities. In this article,we will explore the essential steps and considerations for constructing a balanced cryptocurrency portfolio,equipping you with the knowledge needed to traverse this bold new world with confidence. Whether you’re a novice entering the fray or a seasoned trader looking to refine your strategy, a well-crafted diversification plan could be the key to lasting success in the digital economy.

Understanding the Fundamentals of Diversification in Cryptocurrency

diversification is a strategy employed to mitigate risks and enhance potential returns by spreading investments across various assets. In the realm of cryptocurrency, where volatility is the norm, understanding how to effectively diversify becomes crucial. A well-constructed crypto portfolio should include a mix of established currencies, emerging tokens, and innovative projects that promise long-term growth potential.

Consider segmenting your investment across different categories, such as:

- Large-Cap Coins: Established cryptocurrencies like Bitcoin (BTC) and Ethereum (ETH) that make up a critically important portion of the market.

- Mid-Cap Coins: Promising cryptocurrencies with moderate market capitalizations that may offer higher growth potential.

- New Altcoins: Innovative projects with groundbreaking technology or unique use cases, but with higher risk.

- Stablecoins: Coins pegged to stable assets, providing a buffer against volatility.

It’s also essential to regularly assess your portfolio’s performance and rebalance as necessary. The table below outlines key factors to consider for each category:

| Category | Risk Level | Growth Potential | Market Trend |

|---|---|---|---|

| Large-Cap Coins | Low | Moderate | Stable |

| Mid-Cap Coins | Moderate | High | Variable |

| New Altcoins | High | Vrey High | Speculative |

| Stablecoins | Low | Low | Predictable |

Incorporating various asset types not only shields investors from the uncertainty plaguing the cryptocurrency market but also enables participation in the growth of different sectors. Keeping an eye on market trends and technological advancements can further enhance your diversification strategy, adapting it to the constantly evolving crypto landscape.

Identifying Key Asset Classes: Coins, Tokens, and Stablecoins

In the expansive world of cryptocurrency, a clear understanding of different asset classes is vital for constructing a resilient and balanced portfolio. At the forefront are coins, typically characterized by their native position within their blockchains, serving primarily as mediums of exchange or store of value. notable examples include Bitcoin (BTC) and Ethereum (ETH). Investing in coins can provide exposure to the overall market movement and lasting value, but it’s essential to stay aware of their volatility and market sentiment.

Tokens, conversely, often represent various projects built on existing blockchains and can serve multifaceted purposes. While some tokens work as utility tokens that provide users access to specific services within their ecosystems,others may fall into categories like governance tokens,which allow holders to influence project decisions. A few well-known tokens are Chainlink (LINK) and uniswap (UNI). Understanding the utility and community support behind tokens is crucial, as these factors can substantially impact their potential for growth.

we have stablecoins, which hold a critical role in a diversified portfolio by providing stability amid the inherent volatility of cryptocurrencies. Pegged to stable assets like the US Dollar,coins such as Tether (USDT) and USD Coin (USDC) serve as reliable vehicles for trading and income generation through yield farming. Below is a concise comparison of these asset classes:

| Asset Class | Characteristics | Examples |

|---|---|---|

| Coins | Native to blockchains; store of value | Bitcoin (BTC), Ethereum (ETH) |

| Tokens | Built on blockchains; utility and governance | Chainlink (LINK), Uniswap (UNI) |

| Stablecoins | Pegged to stable assets; low volatility | Tether (USDT), USD Coin (USDC) |

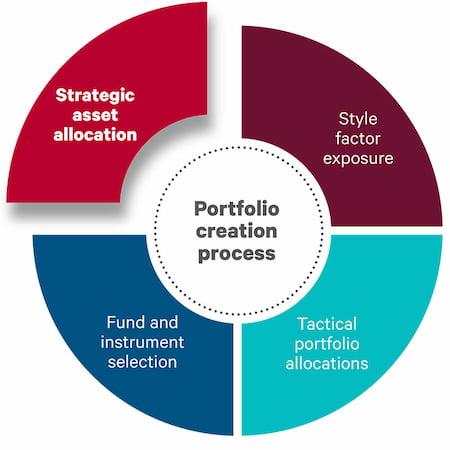

Strategic Allocation: balancing Risk and Reward in Your Portfolio

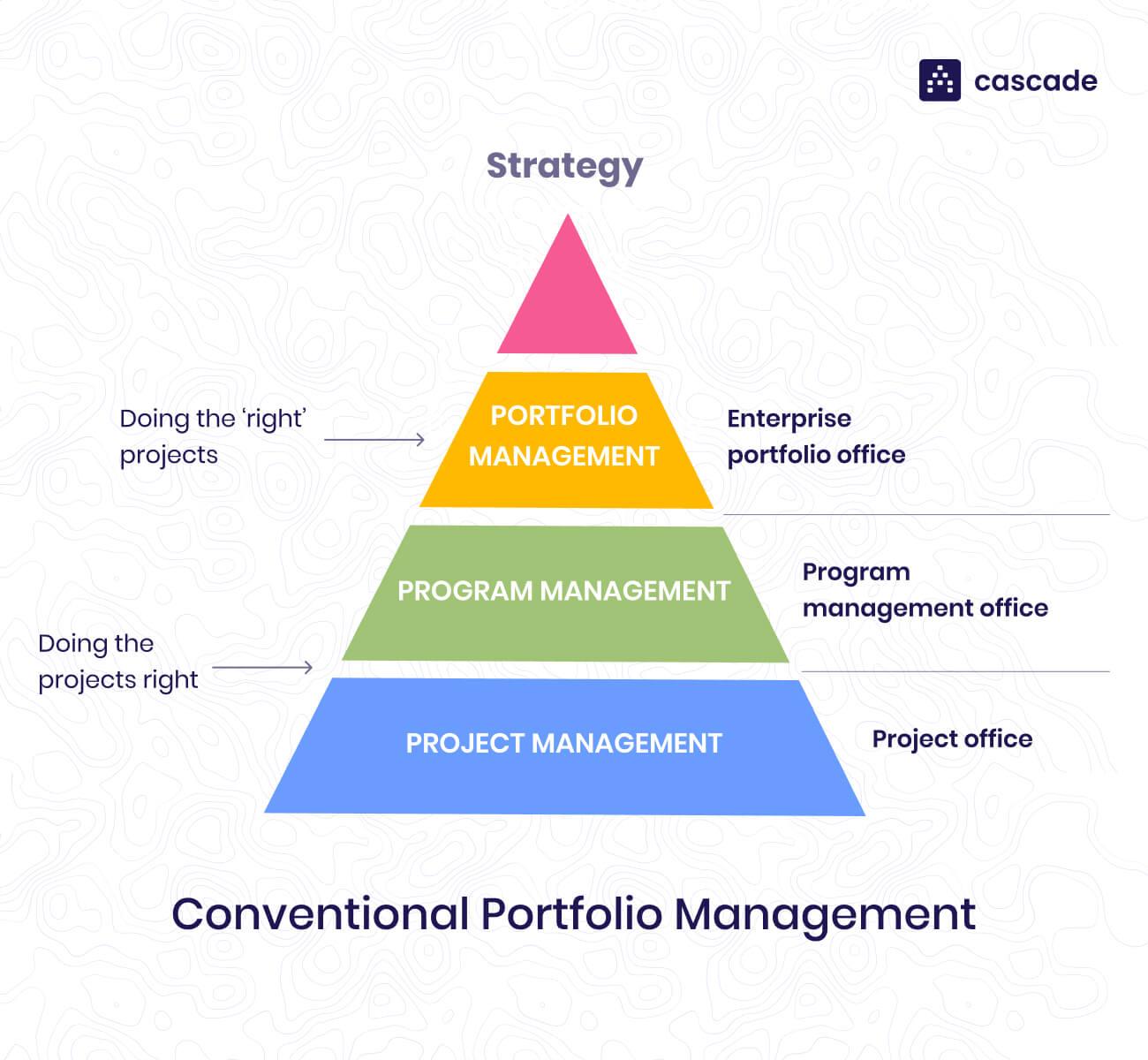

When it comes to building a diversified crypto portfolio, strategic allocation serves as a cornerstone. Effective diversification means distributing your investments among various asset types to mitigate risks while optimizing potential rewards. Consider the following factors when determining your allocation:

- cryptocurrency types: Include a mix of established coins like Bitcoin and Ethereum alongside promising altcoins.

- Market Capitalization: Balance investments between large-cap, mid-cap, and small-cap cryptocurrencies to capture growth opportunities across the spectrum.

- Technological Use Cases: Focus on cryptos with unique functionalities, such as DeFi, NFTs, or payment solutions, to capitalize on different market trends.

Risk tolerance plays a critical role in how you allocate your assets. Younger investors or those willing to embrace higher volatility may choose to allocate a greater percentage toward high-risk, high-reward assets. Conversely, more conservative investors should prioritize stability with a larger portion of their portfolio in less volatile cryptocurrencies. Here are some suggestions to tailor your allocations:

- High Risk/High Reward: Allocate 20-30% to emerging cryptocurrencies.

- Moderate Risk: Invest 40-50% in well-established coins.

- Low risk: Reserve 20-30% for stablecoins and lower-volatility assets.

Monitoring and adjusting your portfolio periodically is essential to maintaining the ideal balance of risk and reward. The cryptocurrency market is highly dynamic, often influenced by regulatory changes, technological advancements, and market sentiment. Implement a schedule to review your portfolio, making changes as necessary. Here’s a simple table to guide your reallocation strategy:

| Review Frequency | Actions |

|---|---|

| Monthly | Assess market trends and news. |

| quarterly | Rebalance based on performance metrics. |

| Annually | Evaluate overall investment goals and adjust allocations. |

Staying Informed: Tools and Resources for Ongoing Portfolio Management

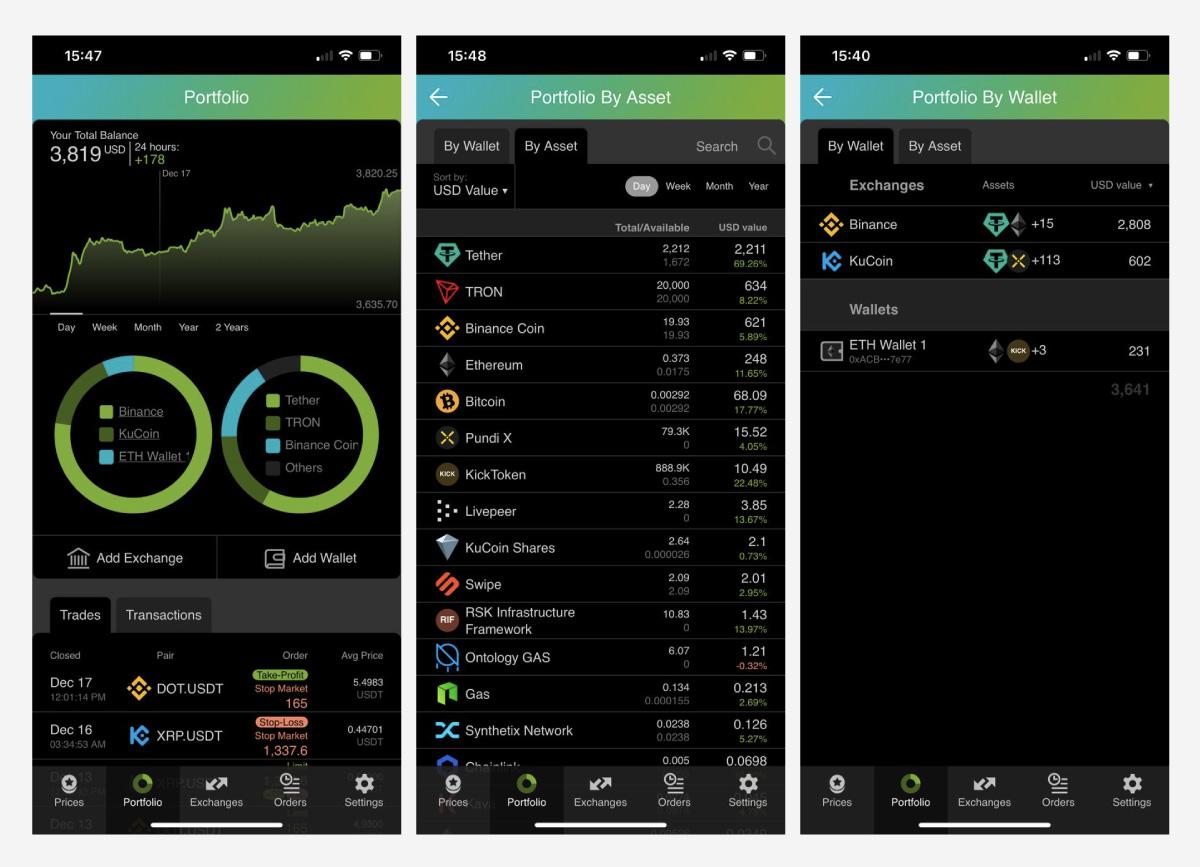

In the rapidly evolving realm of cryptocurrency, staying informed is crucial for effective portfolio management. Several online platforms offer real-time data and analysis tools to help you track market movements and make informed decisions. Popular resources include CoinMarketCap and CoinGecko, where you can find comprehensive price information, market capitalization, and trading volumes for thousands of cryptocurrencies.

Apart from price tracking, leveraging analytical tools can significantly enhance your investment strategy. Platforms like TradingView provide advanced charting tools and indicators, allowing you to visualize trends, set alerts, and conduct technical analyses.Additionally, subscribing to newsletters or following influential voices on social media can keep you updated on market sentiments and emerging trends that may impact your portfolio.

It’s also wise to connect with communities and forums, such as Reddit and Discord channels dedicated to cryptocurrency discussions. Engaging in dialogues with fellow investors can provide insights that you might not find through conventional platforms. To streamline your learning,consider using a simple table to categorize the tools and resources that resonate most with your portfolio management style:

| Tool/Resource | Type | Benefits |

|---|---|---|

| CoinMarketCap | Price Tracking | Real-time market info |

| CoinGecko | Price Tracking | Comprehensive crypto database |

| TradingView | analytical Tool | Advanced charting capabilities |

| Crypto Newsletters | News | timely insights directly to your inbox |

| Reddit/Discord | Community | peer discussions and advice |

Q&A

Q&A: How to Build a Diversified Crypto Portfolio

Q1: Why should I diversify my crypto portfolio?

A1: Diversification is the age-old strategy of not putting all your eggs in one basket. In the volatile world of cryptocurrencies, this approach can help mitigate risks.By spreading your investments across various assets, you decrease the likelihood of a significant loss if one particular coin takes a nosedive. Plus, diverse opportunities can enhance your chances of capitalizing on market trends and innovations.

Q2: How do I determine the right mix of cryptocurrencies for my portfolio?

A2: The “right mix” can vary based on individual risk tolerance, investment goals, and market knowledge. A general guideline might involve allocating a portion to established cryptocurrencies like Bitcoin and Ethereum, which are more stable, while also considering smaller, promising altcoins or emerging tokens that have potential for growth. A well-rounded approach typically involves a combination of large-cap, mid-cap, and even small-cap assets to harness different market dynamics.

Q3: What criteria should I consider when selecting cryptocurrencies?

A3: Think of selecting cryptocurrencies like choosing ingredients for a balanced meal. Look for factors like:

- Market Capitalization: Bigger is often more stable, but don’t overlook promising newcomers.

- Use Cases: Ensure the projects have solid utility and a functional purpose in the crypto ecosystem.

- Advancement Team and Community: A strong, active team and community can signal longevity and commitment.

- Historical Performance: While past performance isn’t a guarantee of future success, it can provide insights into how the asset reacts to market conditions.

- Regulatory Compliance: Understanding the regulatory environment can also be crucial; assets that are compliant may face fewer future obstacles.

Q4: How much of my total investment should I allocate to crypto?

A4: This is akin to asking how much spice to add to a dish—it really depends on personal taste! Many experts suggest starting with 5-10% of your total investment portfolio in cryptocurrencies,especially if you’re new. As you become more pleasant and informed, you can adjust this percentage based on your financial situation and market understanding. Remember, investing in crypto should feel like an exciting addition, not a financial burden.

Q5: Should I invest in crypto regularly?

A5: Regular investing, often called dollar-cost averaging, can be a wise strategy. By consistently investing a fixed amount, you reduce the impact of market volatility, making it less about timing the market and more about building your portfolio gradually. This method helps you remain calm during price fluctuations and can lead to more sizable holdings over time.

Q6: What tools can help me manage my diversified portfolio?

A6: Just as a chef needs the right tools, you need proper resources to manage your crypto portfolio. Consider utilizing portfolio tracking apps like Blockfolio or Delta,which allow you to monitor your assets,performance,and diversification. Additionally, research tools such as CoinMarketCap or CoinGecko provide essential market insight. For those feeling adventurous, there are also portfolio management platforms that offer advanced analytics and optimization capabilities.

Q7: Is it essential to keep updated on the crypto market?

A7: Absolutely! The crypto landscape evolves at lightning speed, driven by technological innovations, regulatory changes, and market sentiments. Staying informed through reputable news sources, following industry leaders on social media, and participating in community forums can definately help you make educated decisions about your portfolio. Remember, knowledge is your best ally in the dynamic world of crypto investing.

Q8: How frequently enough should I revisit and rebalance my portfolio?

A8: While there’s no one-size-fits-all answer, most investors find it beneficial to review their portfolio at least every few months, or in response to significant market shifts. Rebalancing ensures your investment mix aligns with your risk tolerance and goals. If one asset significantly outperforms, you may want to sell a portion of it and reinvest in underperformers to maintain your desired diversification.

By weaving together knowledge and strategy,building a diversified crypto portfolio can become a fulfilling adventure in the digital financial landscape. Happy investing!

In Summary

building a diversified crypto portfolio is akin to crafting a well-rounded masterpiece—requiring a blend of strategy, knowledge, and a dash of creativity. As you navigate the ever-evolving landscape of digital currencies, remember that diversification isn’t just about spreading your investments across different assets; it’s about understanding the unique characteristics and potential of each coin or token.

Embrace the volatility while keeping your feet firmly planted on the ground of research and analysis. Whether you’re a seasoned investor or a curious newcomer, the key lies in striking a balance between risk and reward. Stay informed, adapt to market changes, and don’t shy away from reevaluating your strategies as the crypto space continues to grow and mature.As you embark on this journey, let your portfolio reflect not only your financial goals but also your values and vision for the future. The world of cryptocurrency is vast and filled with opportunities—so take the plunge, keep learning, and may your diversified portfolio flourish in the years to come. Happy investing!