Navigating teh Open Road: Yoru Guide to Securing the Best Truck Insurance Rates

In an era where the wheels of commerce are driven by logistics and transportation, ensuring your truck is aptly protected is more crucial than ever. Whether you’re an owner-operator juggling multiple responsibilities or a seasoned fleet manager overseeing a cadre of vehicles, understanding the landscape of truck insurance can feel daunting.The search for the best rates frequently enough resembles a highway riddled with obstacles, but with the right knowlege, it doesn’t have to be. In this article, we’ll embark on a journey through the essential tips and strategies to help you unlock the best truck insurance rates available. From deciphering coverage options to leveraging discounts, we’ll equip you with the tools needed to confidently navigate your insurance landscape, ensuring you’re not just well-protected but also financially savvy.Buckle up as we set the course for smarter insurance decisions that keep both your budget and your truck secure on the road ahead.

Understanding Your Coverage Needs for Optimal Rates

Before you can secure the best rates for truck insurance, it’s crucial to understand the specifics of your coverage needs.Consider various aspects that could influence your policy selection, such as:

- Truck Type: The vehicle’s make, model, and age can significantly impact your premium. Newer trucks may come with different coverage options than older models.

- Driving History: A clean driving record typically results in lower rates. Ensure to evaluate your or your driver’s history before committing.

- Business Operations: Determine the nature of your work—local versus long-haul trucking can change your risks and insurance requirements.

Additionally, understanding the required coverage levels is essential for balancing costs and protection. Consider the following types of insurance that might be relevant for your situation:

- Liability Coverage: Protects against claims for bodily injury and property damage.

- Physical Damage Coverage: Covers repair or replacement of your truck in case of an accident.

- Cargo Insurance: Safeguards the load being transported from loss or damage.

It’s beneficial to create a table outlining mandatory coverage versus optional coverage to visualize your best insurance fit:

| Coverage Type | Mandatory | Optional |

|---|---|---|

| Liability | ✔️ | |

| Physical Damage | ✔️ | |

| Cargo | ✔️ |

By thoroughly evaluating these factors and documenting your unique operational requirements, you can make informed decisions that not only cater to your coverage needs but also help in negotiating optimal rates.

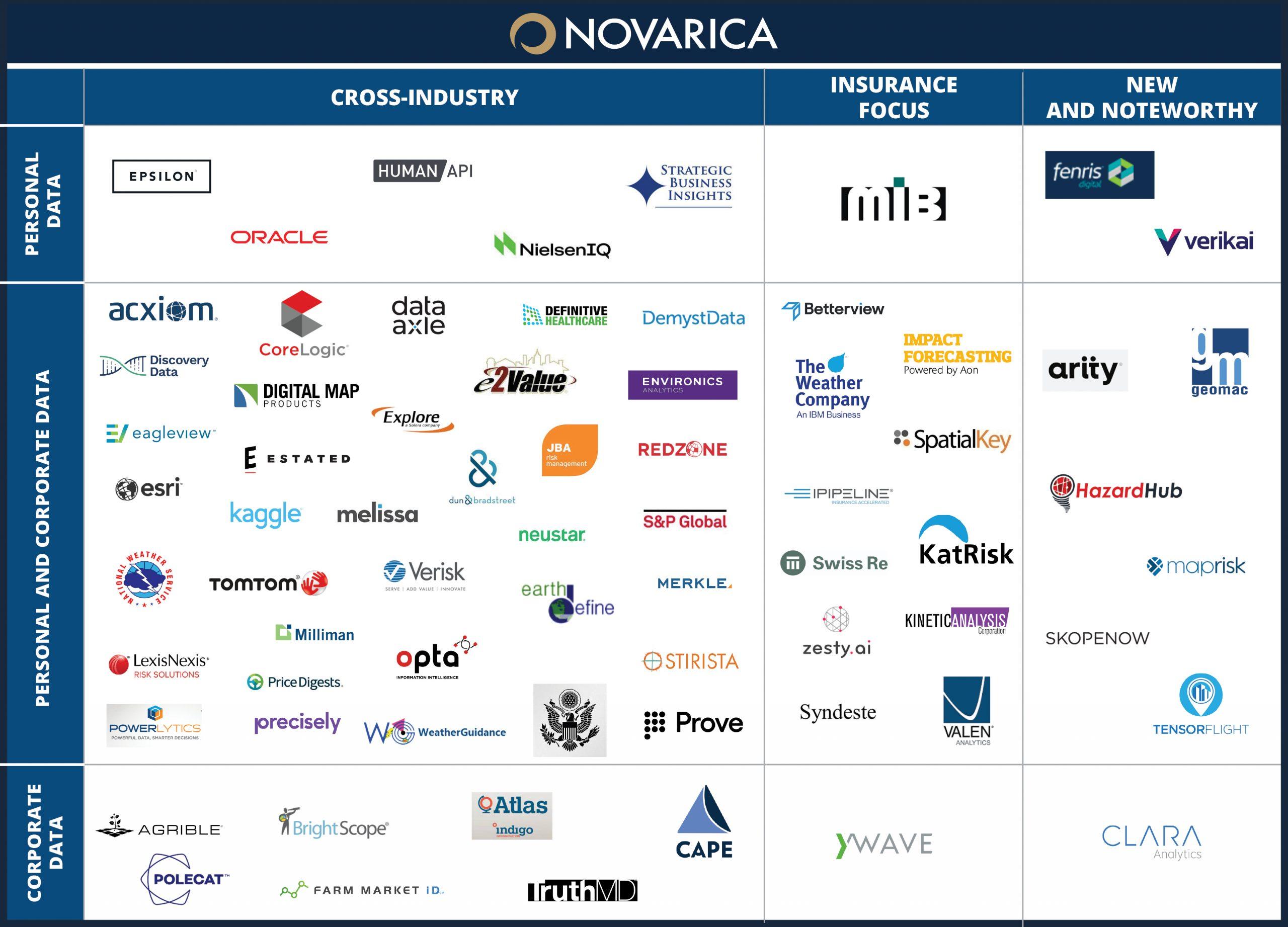

Comparing Insurance Providers: Key Factors to consider

When selecting an insurance provider for your truck, its essential to evaluate several key factors to ensure you secure the most suitable coverage at the best rates. Start by considering the provider’s financial stability and reputation. A company that has consistently strong ratings from agencies such as A.M. Best or Standard & Poor’s suggests they can handle claims promptly and effectively. Look for customer reviews and testimonials to gauge the overall satisfaction rate. this insight will help you determine if their service aligns with your expectations.

Another critical aspect is the range of coverage options offered. Not all truck insurance providers are created equal; some may specialize in certain types of vehicles or industries. Be sure to compare the following:

- Liability Coverage

- Cargo Insurance

- Physical Damage Coverage

- Uninsured/Underinsured Motorist Coverage

Additionally, it’s wise to examine their customer support services and the ease of filing claims. efficient customer service can make a important difference in stressful situations. Below is a comparison table of crucial factors to consider when evaluating various insurance providers:

| Insurance Provider | Financial Rating | Coverage options | Customer Support |

|---|---|---|---|

| Provider A | AA | Comprehensive | 24/7 Support |

| Provider B | A+ | Basic & Plus | Business Hours |

| Provider C | A | All-in-One | 24/7 Chat |

Harnessing Discounts and Savings Opportunities in Truck Insurance

When navigating the landscape of truck insurance, it’s essential to actively seek out discounts and savings opportunities that can greatly reduce your premiums. Many insurance providers offer a variety of ways to lower costs, often linked to your driving history, the type of truck you operate, and even the security features installed.By being proactive and informed, you can take advantage of incentives such as:

- safe Driver Discounts: Rewarded for a clean driving record.

- Bundling Discounts: Savings from combining different types of insurance policies.

- Usage-Based insurance: Reduced rates based on driving behavior monitored by telematics.

- Membership Discounts: Benefits from affiliations with industry organizations.

Along with exploring standard discounts, consider implementing strategies that may lead to further savings. As an example, improving your truck’s safety and security can not only enhance road safety but also lead to lower insurance rates. Many insurers recognize trucks equipped with advanced safety systems, GPS tracking, and theft recovery devices. Additionally, maintaining a good credit score frequently enough contributes to a reduction in premiums.Here’s a rapid comparison table illustrating potential savings through various enhancements:

| Enhancement | Potential Savings |

|---|---|

| Advanced Safety Features | Up to 15% |

| Theft Recovery System | Up to 10% |

| GPS Tracking | Up to 8% |

| Regular Maintenance | Up to 5% |

Navigating the Application process to Lower Your Premiums

Successfully navigating the application process for truck insurance can significantly impact your premiums. Start by compiling a comprehensive profile of your trucking operations, detailing important aspects such as:

- Vehicle Information: Include make, model, year, and VIN numbers.

- Driver profiles: Provide details on driving history, age, and experience.

- Business Operations: Describe your freight types and typical routes.

Thoroughly reviewing your information allows you to present a clear picture to insurers, ensuring accurate quotes.additionally, consider submitting your application through multiple companies simultaneously. This increases your chances of receiving competitive offers. Utilize online comparison tools or engage with an insurance broker to streamline the process. Remember that each insurer has different criteria for risk assessment, so it’s essential to explore a variety of options to locate the best rates available.

In Summary

securing the best truck insurance rates is not just a task; it’s an art that requires careful planning, research, and a touch of savvy negotiation. By understanding your coverage needs, comparing multiple quotes, and leveraging discounts, you can turn what frequently enough feels like a daunting process into a straightforward journey. Remember, the road to the best rates is paved with knowledge and proactive choices. as you navigate through your options, keep in mind that the right insurance policy not only protects your vehicle but also provides peace of mind on every mile you travel.So gear up, stay informed, and drive confidently knowing you’ve made the best choice for your truck insurance needs. Safe travels!