In the fast-paced world of freight and logistics, commercial truck insurance is an essential pillar that protects businesses against unforeseen incidents on the road.However, for many operators, navigating the realm of high-risk commercial truck insurance can feel like steering through a treacherous storm. High-risk status can arise from a variety of factors – whether it’s a history of accidents, driving violations, or operating in hazardous environments. As premiums soar, it becomes crucial for truck owners and fleet operators to adopt smart strategies to manage costs without compromising coverage. In this article, we will explore practical approaches to lowering premiums with high-risk commercial truck insurance companies, revealing insights and tools that can empower you to steer your way toward more favorable terms and conditions. Join us as we unveil methods to effectively mitigate costs and gain peace of mind on the road ahead.

understanding High-Risk Commercial Truck Insurance and Its Implications

High-risk commercial truck insurance is a specialized coverage designed for drivers and companies deemed a greater risk due to various factors, including previous accidents, traffic violations, or the type of cargo transported. These factors increase the likelihood of claims being filed, leading to higher premiums. Insurers assess risks meticulously,resulting in unique coverage options that often include significant liability limits and additional endorsements to cover specialized needs. The complexities involved mean that these policies can be substantially costlier than standard commercial truck insurance, making it essential for businesses to understand their options thoroughly.

To mitigate expenses while still ensuring adequate coverage, companies can adopt various strategies when dealing with high-risk insurers.Consider the following approaches:

- Maintain a clean driving record: Encourage your drivers to prioritize safety and adhere to traffic laws.

- Implement rigorous training programs: Regular training can enhance driving skills and reduce accident risk.

- Utilize telematics: Tracking driver behavior can provide insights,allowing you to adjust practices for safer operations.

- Shop around: Different insurers offer varying rates and coverage, so exploring multiple options is beneficial.

Identifying Key Factors That Influence Premium Rates

Understanding the various elements that impact premium rates is essential for any buisness owner navigating the world of high-risk commercial truck insurance. Operational history plays a significant role; insurers closely examine the claims history, accident frequency, and safety measures implemented by the fleet.In addition, the type of cargo transported can affect rates, as high-value or hazardous materials typically incur higher premiums due to increased risk exposure. Other crucial factors include the driver’s experience and vehicle maintenance records, both of which are pivotal in determining how trustworthy and low-risk the group is perceived to be.

Another important aspect influencing premium rates is the geographical area were the vehicles operate.Regions with higher accident rates or crime rates may see elevated insurance costs. The insurance market trends also fluctuate, meaning that external factors such as natural disasters or legislative changes can indirectly sway premium rates. adopting technology solutions, such as GPS tracking and driver monitoring systems, can create discounts by showcasing responsible operations and proactive risk management strategies. Ensuring your company addresses these factors can help mitigate expenses and make a more favorable impression on insurers.

Strategies for Negotiating Better Rates with Insurance Providers

Negotiating better rates with insurance providers requires a proactive and informed approach. Start by doing comprehensive research to understand the market landscape for high-risk commercial truck insurance. This includes gathering quotes from multiple providers, comparing their coverage benefits, and assessing the overall client satisfaction ratings. Utilize industry reports, online forums, and expert reviews to bolster your case during negotiations. building a strong relationship with your insurer can also prove beneficial; be honest about your business operations and demonstrate a commitment to safety, which can sometimes result in premium discounts.

When you engage in negotiations, prepare a list of points to discuss that underscore your company’s strengths. Highlight your safety records, driver training programs, and maintenance procedures. Presenting statistical evidence, like the following table, can help to reinforce your arguments:

| Factor | Impact on Premiums |

|---|---|

| Accident History | Significant Increase |

| Driver Training Programs | Potential Discount |

| Vehicle Maintenance | Lower Risk Assessment |

| Safety Certifications | Premium Reduction |

Consolidate this information in a clear and succinct manner. Additionally, ask your insurer what discounts might be available that you may not be aware of, and inquire about the possibility of bundling other insurance products for additional savings. Through this thorough planning and open communication, you can strengthen your negotiating position and work towards lowering your premiums effectively.

exploring Alternative Coverage Options for Cost Efficiency

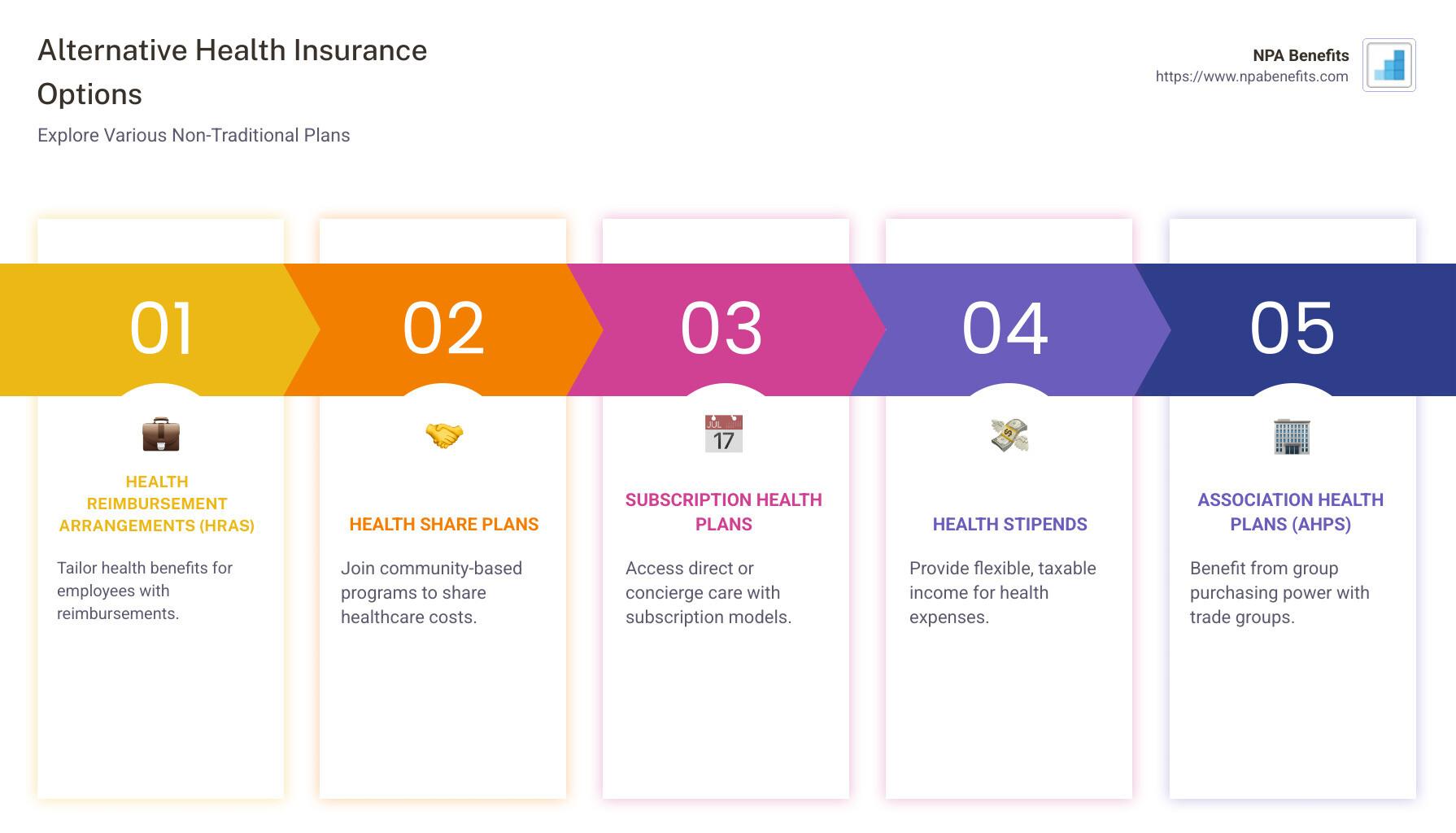

For businesses navigating the complexities of high-risk commercial truck insurance, exploring alternative coverage options can lead to significant savings. One of the first steps is to evaluate self-insurance as a potential strategy. By setting aside a designated amount to cover smaller claims and adopting a higher deductible on your policy, you can frequently enough manage your overall risk more effectively while also reducing premium costs. Consider also pairing your high-risk coverage with usage-based insurance, which adjusts premiums based on actual driving behavior and mileage, rewarding safe driving habits.

another effective approach is to leverage insurance marketplaces that specialize in high-risk clients. These platforms allow you to compare quotes from various insurers,enabling you to select a policy that provides essential coverage without breaking the bank. Requesting an insurance audit can further reveal any unnecessary coverages that can be eliminated or adjusted. Below is a simple comparison of different policy options that may help identify the most cost-effective route:

| policy Type | Typical Coverage | Cost efficiency |

|---|---|---|

| Liability Only | Basic coverage for bodily injury and property damage | Low premiums, limited coverage |

| Full Coverage | Covers collisions, theft, and damage to your truck | Higher premiums, more comprehensive |

| Usage-Based | Adjusts based on driving behavior and mileage | Potentially low costs for safe drivers |

Q&A

Q&A: How to Lower Premiums with High-Risk Commercial Truck Insurance Companies

Q1: What is high-risk commercial truck insurance?

A1: High-risk commercial truck insurance is a specialized type of coverage designed for trucking businesses deemed to be at a higher risk due to various factors, such as a history of accidents, inexperienced drivers, or certain driving patterns. While this type of insurance often comes with higher premiums, it is essential for companies that operate in more hazardous environments.Q2: Why are premiums typically higher for high-risk commercial truck insurance?

A2: Premiums are generally higher for high-risk insurance due to the increased likelihood of claims. Insurers evaluate risk based on past driver behavior, vehicle condition, and industry practices. If a trucking company has a higher chance of incurring costs due to accidents or damages, they will face steeper insurance rates.Q3: What are some strategies to lower premiums with high-risk commercial truck insurance?

A3: Here are several effective strategies:

- Improve Safety Practices: Investing in training programs and safety protocols can reduce accidents, improving your risk profile.

- Implement Telematics: Using technology to monitor driving behaviors can help identify risky habits and promote safer driving patterns, potentially leading to lower premiums.

- maintain Your Fleet: Regular maintenance reduces the likelihood of mechanical failures and accidents, which can influence insurance costs.

- Increase Deductibles: Opting for a higher deductible can lower your premium. However,it’s crucial to ensure that your company can cover the deductible in the event of a claim.

- Shop Around: Different insurers assess risk differently, so obtaining quotes from multiple high-risk commercial truck insurance providers can uncover more competitive premium options.

- Bundle Policies: Consider bundling your high-risk commercial truck insurance with other coverage options. This can sometimes result in discounts.

Q4: Are there specific insurers that cater to high-risk trucking businesses?

A4: Yes, there are many specialized insurance companies that focus on high-risk commercial truck insurance. These companies frequently enough have tailored programs and coverage options designed to accommodate the unique needs of high-risk drivers. It’s beneficial to research these providers to find one that aligns with your company’s specific risk exposures.

Q5: How can I demonstrate to insurers that my company is becoming less risky?

A5: To demonstrate reduced risk,maintain clear and consistent records of your safety improvements,investment in driver training,and proactive measures taken to ensure operational safety. Insurance companies appreciate evidence such as lower incident rates, completed safety audits, and any certifications obtained by drivers.

Q6: Should I consider working with an insurance broker?

A6: Absolutely! An insurance broker with experience in high-risk commercial truck insurance can provide invaluable insights and help you navigate the complex insurance landscape. They can assess your individual risk factors, present you with tailored options, and negotiate on your behalf to secure more favorable terms.

Q7: What pitfalls should I avoid when managing high-risk commercial truck insurance?

A7: Be cautious of:

- Skipping coverage or opting for insufficient limits to save money, which can lead to significant financial strain during a claim.

- Focusing solely on price rather than the policy’s coverage. Always assess what protection you are actually receiving.

- Neglecting to review and update your policies regularly; as your business evolves, so should your insurance.

while high-risk commercial truck insurance may come with its challenges, adopting these strategies can help lower your premiums, streamline operations, and ensure comprehensive coverage for your business.

Insights and Conclusions

navigating the world of high-risk commercial truck insurance doesn’t have to feel like driving through a labyrinth. Armed with the insights we’ve explored, you can take proactive steps to reduce your premiums without compromising on coverage. By understanding the nuances of your risk profile, shopping around for competitive rates, and leveraging available discounts, you can position your business for financial stability. Remember, the road to finding the right coverage is not merely a destination but a journey of informed decision-making. Think of it as tuning your engine for optimal performance—when everything is running smoothly, you can focus on what truly matters: getting your cargo safely to its destination. So, buckle up and embark on this journey with confidence; a more financially sound and secure tomorrow awaits. Safe travels!