In the bustling world of car ownership, the thought of financing can often feel like navigating a labyrinth. For many first-time buyers, the journey to securing that perfect vehicle is riddled with complex terms, hidden fees, and puzzling options. yet, understanding car financing doesn’t have to be a daunting task. Imagine stepping into the driver’s seat of your financial future with clarity and confidence. In this beginner’s guide, we will demystify the various facets of car financing, breaking down the intricate concepts and practical steps you need to embark on your automotive adventure.Whether you’re eyeing a sleek sedan or a rugged SUV, we’re here to equip you with the knowledge to make informed decisions that pave the road to ownership. Buckle up, as we take you on a ride through the essentials of financing your car!

Exploring Financing Options: A Roadmap for New car Buyers

When considering a new vehicle,understanding your financing options can substantially impact your experience and financial well-being. There are various pathways available that cater to different needs and credit situations.Some of the most common choices include:

- Customary Auto Loans: These loans are often provided by banks or credit unions and require a fixed monthly payment over a set term, typically ranging from three to seven years.

- Leasing: Instead of buying, leasing allows you to drive a new car for a predetermined time, usually two to four years, often with lower monthly payments

- Dealership Financing: Many dealerships offer financing options with incentives such as low or even zero percent interest rates, making it an attractive choice.

To help you choose the right financing option, it’s essential to consider your budget and long-term plans. A helpful approach is to assess your total cost of ownership, which includes more than just the monthly payment. Create a simple comparison table:

| Financing Option | Pros | Cons |

|---|---|---|

| Traditional Loan | Ownership, No mileage limits | Higher payments, Depreciation |

| Leasing | Lower payments, Newer models | No ownership, Mileage restrictions |

| Dealership Financing | Convenience, Incentives | Perhaps higher rates, Not always the best deal |

By evaluating these options carefully and aligning them with your financial goals and lifestyle preferences, you position yourself for a satisfying car-buying journey. Remember to read the fine print and ask questions to clarify any uncertainties before committing to a financing plan.The right choice will depend on your immediate capabilities and long-term aspirations.

decoding the Terminology: Key Terms Every Buyer Should Know

When navigating the world of car financing, familiarizing yourself with essential terminology can empower you to make informed decisions. Here are some key terms that you will frequently encounter:

- APR (Annual Percentage Rate): This reflects the total cost of borrowing money, including interest and any fees, expressed as a percentage.

- Down Payment: The initial amount you pay upfront when purchasing a vehicle, which reduces the amount financed.

- Loan Term: The length of time you have to repay your auto loan, usually ranging from 36 to 72 months.

- Trade-In Value: The amount a dealer will credit you for your existing vehicle when you purchase a new one.

- Monthly Payment: The amount you will pay each month toward your auto loan, which is determined by the loan amount, interest rate, and term.

Understanding these terms will enhance your ability to negotiate and secure the best financing deal.Additionally, consider familiarizing yourself with othre related concepts:

| term | Description |

|---|---|

| Equity | This represents the difference between the car’s value and the amount owed on it. |

| Credit Score | A numerical representation of your creditworthiness, influencing financing options. |

| Secured Loan | A loan backed by collateral, in this case, the vehicle itself. |

Evaluating Your Budget: Smart strategies for Affordable Payments

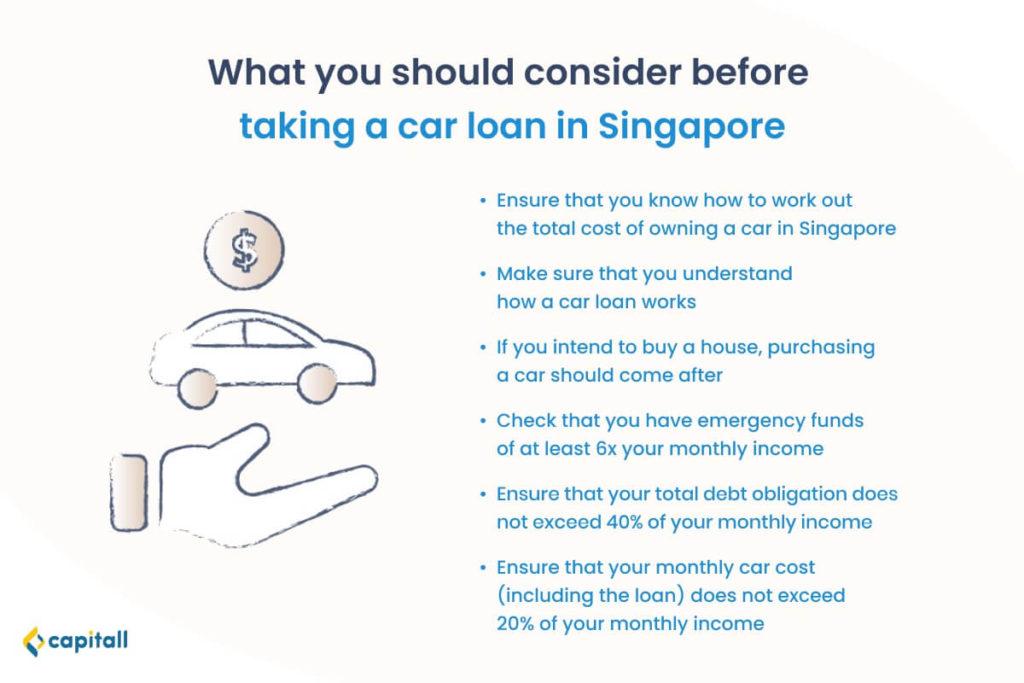

When it comes to managing your car financing, evaluating your budget is crucial. Start by identifying your total monthly income and then charting out your fixed and variable expenses. This will give you a solid foundation to determine how much you can comfortably allocate towards your car payments each month. Consider the following strategies to maximize affordability:

- Prioritize Needs Over Wants: Distinguish essential expenses such as housing, utilities, and food from discretionary spending. This will help clarify how much you have left for a car loan.

- Research Financing Options: Explore different loan providers and interest rates. A lower interest rate can significantly reduce your monthly payment.

- Factor in Additional Costs: don’t forget about insurance, registration, and maintenance. Include these in your budget to avoid unpleasant surprises down the road.

To assist in visualizing how your budget can accommodate a car payment, consider creating a simple comparison table of various loan amounts and their corresponding monthly payments based on different interest rates. This can help you grasp the impact of financial decisions:

| Loan Amount | Interest Rate | Monthly Payment |

|---|---|---|

| $15,000 | 3% | $431 |

| $20,000 | 4% | $484 |

| $25,000 | 5% | $530 |

Navigating Loan Terms: Choosing the Best Plan for Your Needs

When you’re setting out to finance a car, understanding the various loan terms is crucial to finding a plan that fits your financial landscape. Loan terms can range from 24 to 72 months,impacting your monthly payment and the overall cost of the vehicle. Shorter terms often mean higher monthly payments but less interest paid while longer terms might decrease your monthly outlay at the expense of paying more interest over time. Therefore, it’s essential to weigh the granularity of the terms against your current financial situation and future goals. Consider the following factors:

- monthly Budget: Assess what you can afford without stretching your finances too thin.

- Total Interest Cost: calculate how much interest you’ll pay over the life of the loan.

- Adaptability: Look for loans that offer options for pre-payment without penalties.

Additionally, the type of loan can influence your choice significantly. Traditional loans are common, but you might also come across options like leases or specialized financing programs that cater to specific buyers. Different lenders offer varied terms, so it’s worth comparing offers from multiple sources, including banks, credit unions, and dealership financing. Here’s a simplified comparison of typical car financing options:

| Loan Type | Typical Term Length | Pros | Cons |

|---|---|---|---|

| Traditional Loan | 36-72 months | Ownership, flexible terms | Higher payments for shorter terms |

| Lease | 24-48 months | Lower payments, latest models | No ownership, mileage limits |

| special Financing | Varies | Offers for first-time buyers | May require a larger down payment |

The Conclusion

As we wrap up our journey through the world of car financing, it’s clear that understanding this essential aspect of car ownership is key to making informed decisions. Whether you’re leaning towards leasing or buying, deciphering interest rates, or navigating your credit score, knowledge is your strongest ally.

Remember, the road to financial literacy in automotive purchases isn’t a sprint; it’s a thoughtful expedition. Equip yourself with the facts and take the time to evaluate your options.With the right guidance and a little patience, you can drive away with peace of mind, confident that you’ve secured a deal that aligns with your budget and lifestyle.

whether you’re a first-time buyer or looking to upgrade your ride, being educated about car financing empowers you not just today, but for every journey ahead. Safe travels on the road of financial empowerment, and may you find the perfect car that complements both your needs and your wallet.