In the vast landscape of the trucking industry, where the endless hum of engines and the rhythmic sway of trailers characterize the daily grind, a vital yet often overlooked aspect remains shrouded in ambiguity: trailer interchange and non-owned trailer coverage. For fleet operators, logistics managers, and trucking enthusiasts alike, grasping these concepts is essential for navigating the complex interplay of ownership, liability, and risk management. As businesses increasingly rely on shared resources too streamline operations and optimize costs, understanding the nuances of trailer interchange agreements and the protections offered by non-owned trailer coverage can mean the difference between seamless operation and unexpected financial pitfalls. In this article, we will demystify these critical components, shedding light on their importance, implications, and how they can safeguard your operations in a dynamic and ever-evolving industry.

Navigating the Basics of trailer Interchange Agreements

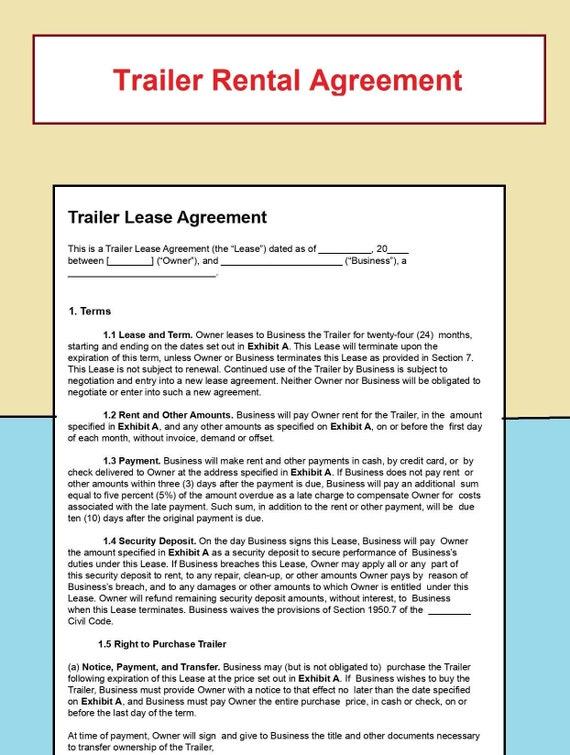

Understanding the fundamental components of a trailer interchange agreement can significantly benefit trucking companies and independent haulers. These contracts outline the terms and conditions under which a trailer can be exchanged between parties, ensuring that both sides are protected against potential liabilities. Key elements typically included are the specifications of the trailers, responsibilities for maintenance and repairs, and stipulations regarding insurance coverage. By establishing clear rules before engagement, parties can avoid disputes and ensure seamless operations.

when assessing the nuances of non-owned trailer coverage, itS meaningful to consider how it integrates with interchange agreements. This type of insurance typically encompasses damage or theft of trailers that are not owned by the insured. Factors influencing coverage may include:

- Geographical Limits: Scope of coverage may vary based on location.

- Duration of Use: Policies often account for specific timeframes during which the trailer is in use.

- Exclusions: Certain events may not be covered, such as wear and tear.

To provide a clearer understanding, consider the following comparison table:

| Aspect | Owned Trailer | non-Owned Trailer |

|---|---|---|

| Insurance Responsibility | Owner’s policy | Insured’s policy |

| Risk Mitigation | Fully under owner’s control | Subject to contract terms |

| Liability Coverage | Defined and owned | Varies by agreement |

Key Differences Between Owned and Non-Owned Trailer Coverage

When considering trailer coverage, it’s crucial to understand the distinctions between owned and non-owned trailer coverage, as they cater to different needs and liabilities.Owned trailer coverage generally applies to trailers that you, or your business, own outright.This type of insurance typically covers damages resulting from accidents, theft, and other occurrences specific to your owned equipment. Notable features of owned trailer coverage include:

- Comprehensive Protection: Offers broad coverage including physical damage, liability, and contents within the trailer.

- Customized Policies: Tailored options based on the specific use of the trailer.

- Exclusivity: Only covers trailers listed under the policyholder’s name.

In contrast, non-owned trailer coverage is designed for situations where you are using trailers that belong to others, which might potentially be rented, borrowed, or or else not owned by your company. This coverage helps shield you from financial loss when you’re responsible for the trailer while it’s in your possession. Key aspects of non-owned trailer coverage include:

- Liability Coverage: Protection against third-party claims arising from the use of a non-owned trailer.

- Limited Insurance Scope: Primarily covers liability; physical damage often depends on the trailer owner’s policy.

- Flexible Usage: Ideal for businesses that use varying trailers for transportation without ownership.

Assessing Risks and Benefits of Non-Owned Trailer Policies

When considering non-owned trailer policies,it’s crucial to evaluate the potential risks and benefits associated with their use. Risks can include liability for damage to the trailer itself,and also possible legal complications resulting from accidents involving non-owned trailers. Additionally,the lack of coverage for certain types of equipment or scenarios might expose businesses to financial losses. Each association must analyze its operations to determine how frequently enough non-owned trailers are utilized and the conditions under which they are used, as this will inform their risk exposure. Businesses should also be mindful of the specific terms and coverage limits of their policies to ensure alignment with their risk tolerance and operational needs.

On the other hand, ther are significant benefits to having a non-owned trailer policy in place. these policies can provide financial protection against unexpected towing expenses or losses, saving companies a considerable amount in repair and replacement costs. Moreover, they can enhance operational flexibility, allowing businesses to engage in trailer interchange agreements without the fear of being liable for unforeseen incidents. Here are some key advantages:

- Improved financial security

- Increased operational agility

- Peace of mind during trailer interchange operations

tips for Securing Comprehensive trailer Coverage solutions

Securing comprehensive trailer coverage solutions requires a strategic approach to ensure your assets are well protected. Start by conducting a thorough risk assessment of your operational needs. This involves identifying the types of trailers you frequently use and the potential risks associated with each. Understanding the differences between interchange agreements and non-owned trailer coverage is crucial. ensure that your insurance provider offers tailored options that meet the specific requirements of your fleet and address the various scenarios that may arise during trailer use.

Once you’ve assessed your needs, you’ll want to seek out insurance providers with a strong reputation for customer service and claims handling. Consider these key factors when choosing your coverage:

- Customization: Look for policies that can be tailored to match the unique specifications of your trailers.

- Limits and Deductibles: Compare various limits and deductibles to find a suitable balance between cost and coverage.

- Policy Exclusions: Read the fine print to understand what is and isn’t covered by your plan.

- Reputation: Investigate customer feedback to assess the reliability of potential insurers.

| Coverage Type | Details |

|---|---|

| Interchange Coverage | Protects trailers in transit between carriers, often with specified limits. |

| Non-Owned Trailer Coverage | Covers trailers that you do not own but are under your care or use. |

| Physical Damage coverage | Compensates for damages to the trailer from accidents or theft. |

| Liability Coverage | Protects against third-party claims for bodily injury or property damage. |

To Wrap It Up

As we journey through the intricate landscape of trailer interchange and non-owned trailer coverage, it becomes clear that understanding these concepts is not just beneficial, but essential for ensuring a smooth operation in the transportation industry. Whether you are a fleet manager, an owner-operator, or simply exploring the nuances of logistics, having a firm grasp on these issues can provide peace of mind and enhance your operational efficiency.

Navigating the complexities of insurance requirements and liability responsibilities can sometimes feel daunting. However, being well-informed about the nuances of trailer interchange agreements and the value of non-owned trailer coverage can empower you to make smarter decisions that protect your assets and streamline your business practices.

equipping yourself with knowledge and the right coverage can safeguard against unforeseen challenges, allowing you to focus on what truly matters: keeping your wheels in motion and your business thriving. With the right tools and understanding at your disposal, you can drive confidently into the future of transportation.