buying a car is often a thrilling experience, filled with visions of freedom on the open road and the thrill of new adventures. Yet, behind the excitement lies a crucial step that every potential car buyer must navigate: understanding the necessary documentation. Whether you’re purchasing your first vehicle, upgrading to something more fitting, or diving into the world of used cars, having the right documents in hand can streamline the process and make your journey much smoother. In this article, we will outline the essential paperwork you need to secure your dream car, ensuring that you’re well-prepared to drive off with confidence and peace of mind.

Essential Identification Requirements for Car Buyers

When embarking on the journey of purchasing a vehicle, having the right documentation is crucial to ensure a smooth transaction. Here are the key items to prepare:

- Driver’s license: A valid driver’s license serves as primary identification and demonstrates your eligibility to drive.

- Proof of Insurance: Before driving off in your new car, you must provide evidence of insurance coverage.

- Social Security Number: This may be required for financing applications, allowing creditors to check your credit history.

- Proof of Income: Recent pay stubs or tax documents might potentially be necessary to verify your financial stability if you are considering a loan.

In addition to identity verification, certain documents may help streamline the buying process. Depending on your situation, consider preparing:

| Document Type | Purpose |

|---|---|

| Credit Report | Gives sellers insight into your creditworthiness. |

| Trade-In Title | Required if you plan to trade in your existing vehicle. |

| Vehicle History Report | Useful for buyers seeking transparency on used cars. |

Navigating Financial Documentation for Your Vehicle Purchase

When embarking on the journey of purchasing a vehicle, a well-organized documentation process is crucial. Initially, you’ll need to ensure you have your government-issued ID ready, as this serves as proof of identity during the transaction. In addition, keep handy your proof of insurance, which most dealerships require before finalizing the purchase. If you intend to finance your vehicle, be prepared to present income verification documents such as pay stubs or bank statements. This clears a pathway for lenders to assess your financial capability.

Don’t forget to gather your credit report, as it will provide vital insights into your creditworthiness. It’s also beneficial to have a trade-in title if you’re looking to exchange your old vehicle for a new one. Lastly, consider compiling any financial statements that demonstrate your overall financial health. Here’s a quick reference table of essential documents:

| Document | Description |

|---|---|

| Government-issued ID | Proof of identity (e.g., driver’s license) |

| Proof of Insurance | Document verifying insurance coverage |

| Income Verification | Pay stubs or bank statements for financing |

| Credit Report | Insights on your creditworthiness |

| Trade-in Title | For exchanging your current vehicle |

Understanding the Role of Insurance Information in Car Buying

when embarking on the journey to buy a car, understanding how insurance information intertwines with your purchase is pivotal. Insurance details not only play a crucial role in the overall cost of ownership but also influence the types of vehicles that might potentially be suitable for you. Before you finalize a deal, it’s essential to gather pertinent documentation, including your driver’s license, proof of address, and your driving history, as these documents will help insurance companies determine your risk profile and calculate your premiums. Additionally,knowing the vehicle’s make,model,and year is vital since these factors significantly impact insurance rates.

Before heading to the dealership, consider these critical insurance-related details that you may need to provide:

- Insurance provider information: if you’re switching cars, your current insurer will need to update your policy.

- Coverage type: decide whether you want full coverage or just liability, which may affect your vehicle choices.

- Deductible preference: Higher deductibles can lower your premiums, but they will increase out-of-pocket costs in an accident.

| factor | Impact on Insurance |

|---|---|

| Vehicle Age | Older cars may cost less to insure. |

| Safety Features | Cars with advanced safety tech frequently enough have lower premiums. |

| Location | Certain areas may have higher theft rates, increasing costs. |

Finalizing the Deal: Additional Papers you Might Need

Once you’ve agreed on the price of your new vehicle, it’s important to be fully prepared with the necessary documentation to complete the transaction smoothly.Beyond the basic paperwork, you might also need to present a few additional items. These can differ depending on your locality and the type of transaction, but being prepared will save you time and potential headaches at the dealership.

- Insurance Information: Proof of insurance is often required to finalize the sale. It’s good to have a policy ready that covers your new vehicle.

- Trade-In Documents: If you’re trading in your old car, gather the title, registration, and any loan payoff information.

- Loan Approval Letter: If financing, bringing in a pre-approval letter from your financial institution can expedite the process.

- Identification: A valid driver’s license is mandatory, and some dealers may ask for additional forms, like a passport or social security card.

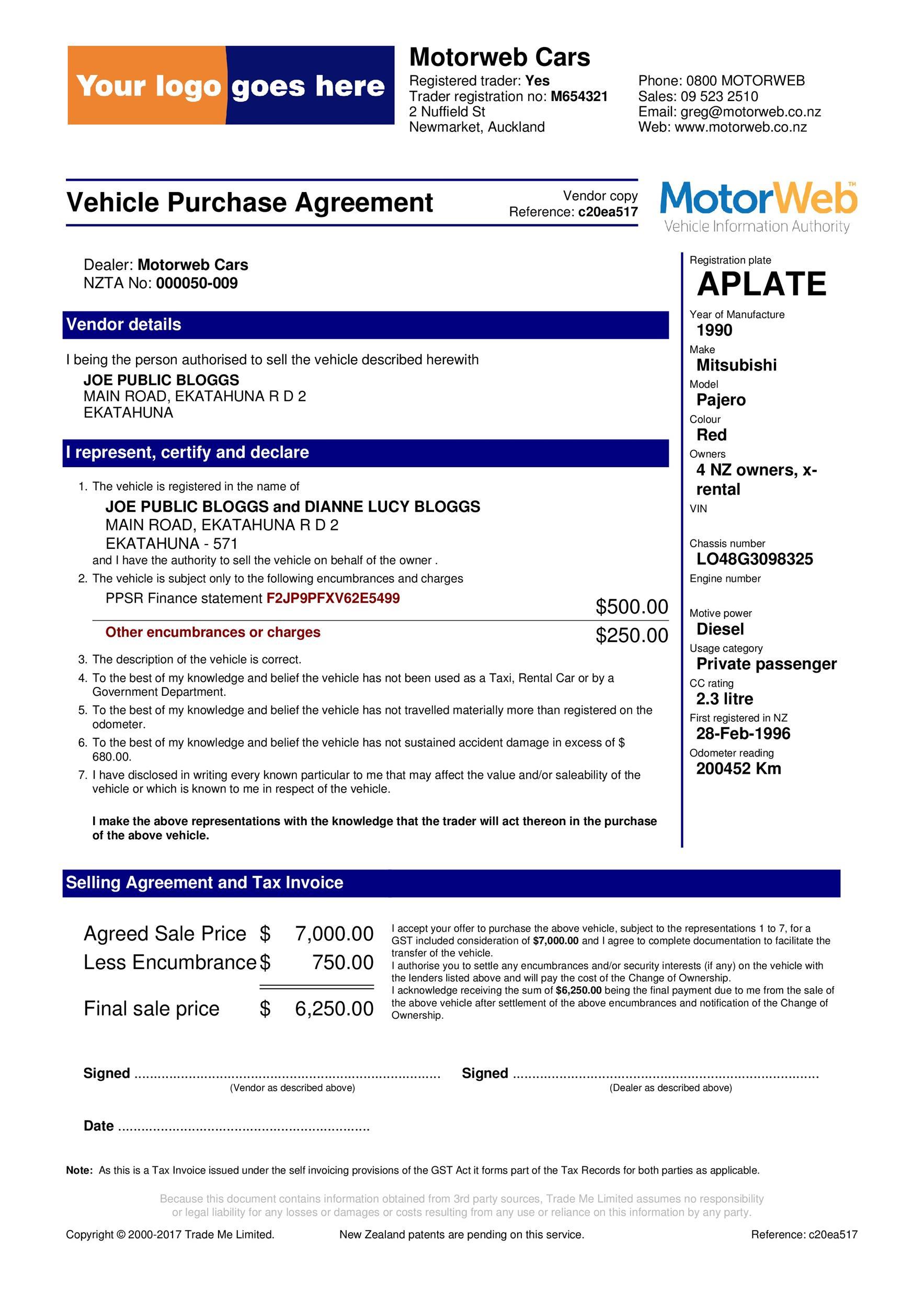

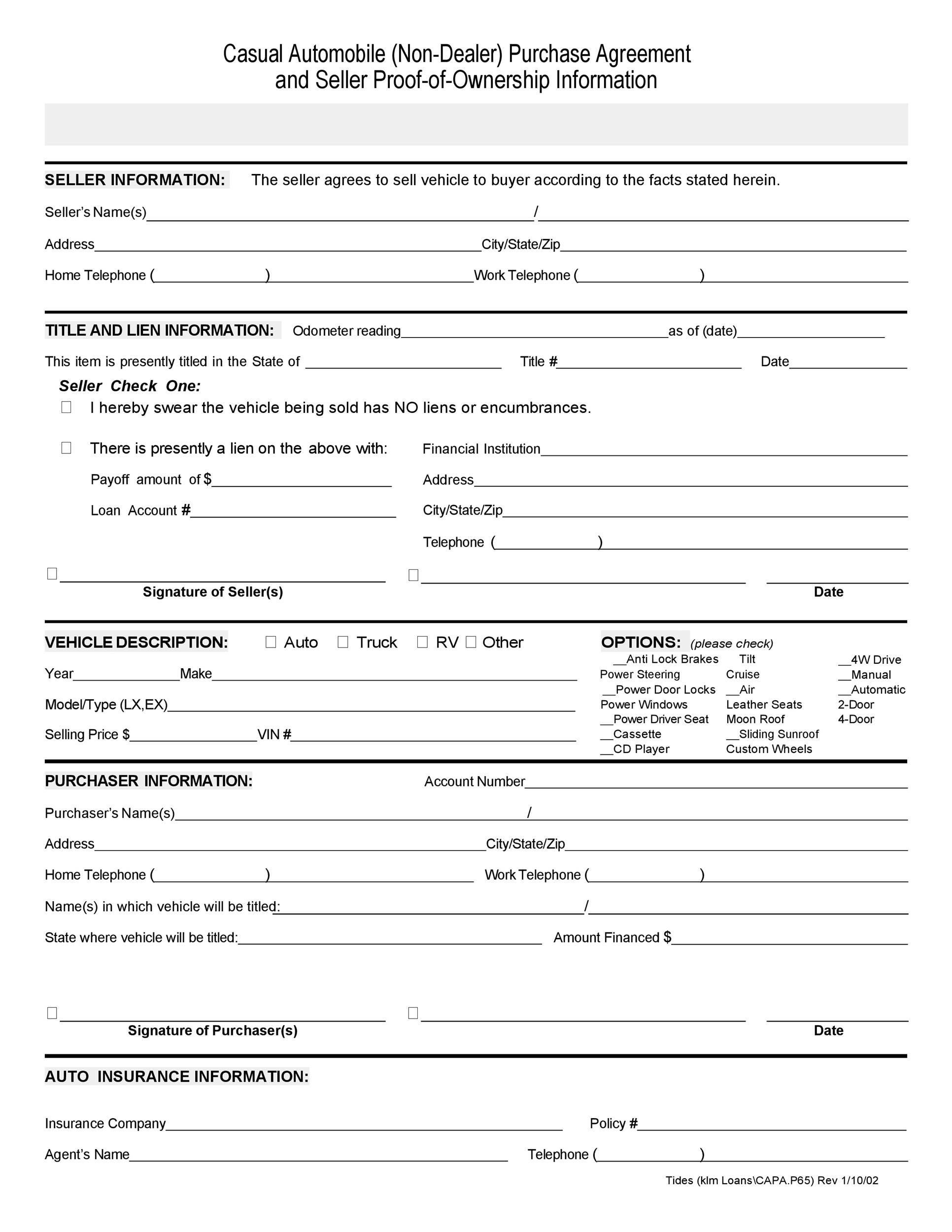

- Purchase Agreement: Ensure you have a signed purchase agreement that outlines the specifics of your deal.

Additionally,some dealers might request documentation specific to your financial situation or past purchases. Here’s a quick reference table of items that could be relevant:

| Document | Purpose |

|---|---|

| Proof of income | To verify financial stability for loan approvals. |

| government ID | To confirm your identity and age. |

| Residence Verification | To establish your address; often a utility bill suffices. |

To wrap It Up

navigating the world of car buying doesn’t have to feel like a daunting road trip filled with unexpected detours. Armed with the right documents, you can ensure a smooth journey from the moment you step into the dealership to when you drive off in your new vehicle. Remember, each state may have its own specific requirements, so a little research tailored to your location can go a long way. Whether you’re a seasoned buyer or a first-time driver, being prepared with the necessary paperwork not only streamlines the process but also empowers you to make informed decisions. As you embark on your next automotive adventure, let this knowledge be your guiding map, steering you toward a accomplished purchase and the open road ahead. Safe travels!