In a world where financial independence ofen feels like an elusive dream, the advent of cryptocurrency offers a beacon of hope for many aspiring investors. The allure of passive income, that coveted revenue stream that flows in effortlessly, has never been more accessible, thanks to the innovative tools and platforms sprouting within the crypto landscape. Whether you’re a seasoned trader or a curious newcomer, the potential to generate income without actively managing your assets is an enticing proposition. This article delves into a variety of passive income ideas using crypto investments, exploring the diverse opportunities available—from staking and yield farming to lending and beyond. Buckle up as we navigate the dynamic intersection of technology and finance, revealing how you can harness the power of cryptocurrencies to cultivate a more prosperous future, all while enjoying the freedom to pursue your passions.

exploring Staking Opportunities for Steady Crypto Returns

Staking has emerged as a noteworthy method for investors seeking to earn passive income through their cryptocurrency holdings. By participating in the staking process, users essentially lock their crypto assets in a network to support blockchain operations, which, in turn, allows them to earn rewards. This practice not only contributes to the health of the network but also provides an attractive avenue for generating consistent returns. Some of the most popular coins supporting staking include:

- Ethereum 2.0 – Transitioned from proof-of-work to proof-of-stake.

- Cardano (ADA) – Offers high potential APR for stakers.

- Tezos (XTZ) – Users can bake their tokens to earn rewards.

Understanding the staking process is essential for maximizing your earnings. typically, rewards are distributed as new coins generated by the network, making the returns potentially compound over time. However, it’s crucial to consider various factors, such as network fees, minimum staking amounts, and lock-up periods, as they can significantly impact your overall yield. Below is a simplified comparison of staking rewards across several well-known networks:

| Cryptocurrency | Annual Percentage Rate (APR) | Minimum Staking |

|---|---|---|

| Ethereum 2.0 | 5-10% | 0.01 ETH |

| Cardano (ADA) | 4-6% | 10 ADA |

| Tezos (XTZ) | 5-7% | 1 XTZ |

As you delve into the world of staking, it’s important to choose a reliable wallet or staking platform that aligns with your investment strategy and risk tolerance. Different platforms may offer varying user experiences, fee structures, and security measures. Researching user reviews and success stories can provide valuable insights into which option is best suited for your needs. Always remember that while staking can be a robust source of passive income, diversifying your investments remains key to managing risks in the ever-evolving crypto landscape.

Diving into Yield Farming: Maximizing Your Digital Assets

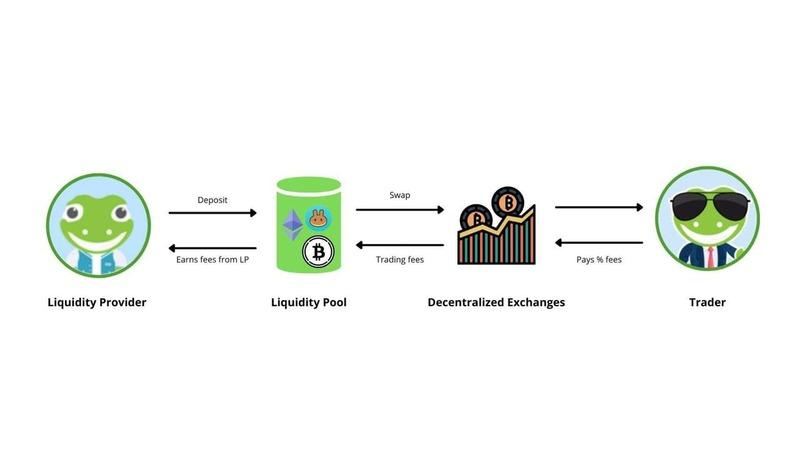

Yield farming is an innovative approach that allows cryptocurrency holders to unlock the potential of their digital assets while generating passive income. By lending or staking tokens in decentralized finance (DeFi) protocols, users can earn additional cryptocurrency rewards.This process not only maximizes asset utilization but also enhances the overall engagement within the blockchain ecosystem. To get started,users typically need to understand the various farming strategies available,which might include:

- Liquidity Mining: Providing liquidity to decentralized exchanges (DEXs) and earning rewards in return.

- Staking: Locking your assets in a platform to earn interest or governance tokens.

- Yield Aggregators: Utilizing platforms that automatically shift funds between different opportunities for optimal returns.

When choosing yield farming opportunities, it’s crucial to consider factors such as risk levels, potential returns, and smart contract vulnerabilities. As the DeFi space grows, so do the risks associated with it. An assessment of factors like liquidity pool size, annual percentage yield (APY), and token volatility can greatly influence the decision-making process. A comparative analysis can be made using the following simple table:

| Pooling Option | APY | Risk Level |

|---|---|---|

| Uniswap ETH/DAI | 12% | Medium |

| Aave DAI Lending | 6% | Low |

| Curve Finance BTC/ETH | 10% | High |

In practice,the world of yield farming is not only about seeking the highest returns but also involves a strategic mindset. Diversifying investments across various protocols can mitigate risks, while carefully monitoring performance can help in making timely adjustments.As trends shift within the market, understanding the dynamics of yield farming can open up new avenues for wealth creation and enhance your portfolio’s overall stability.

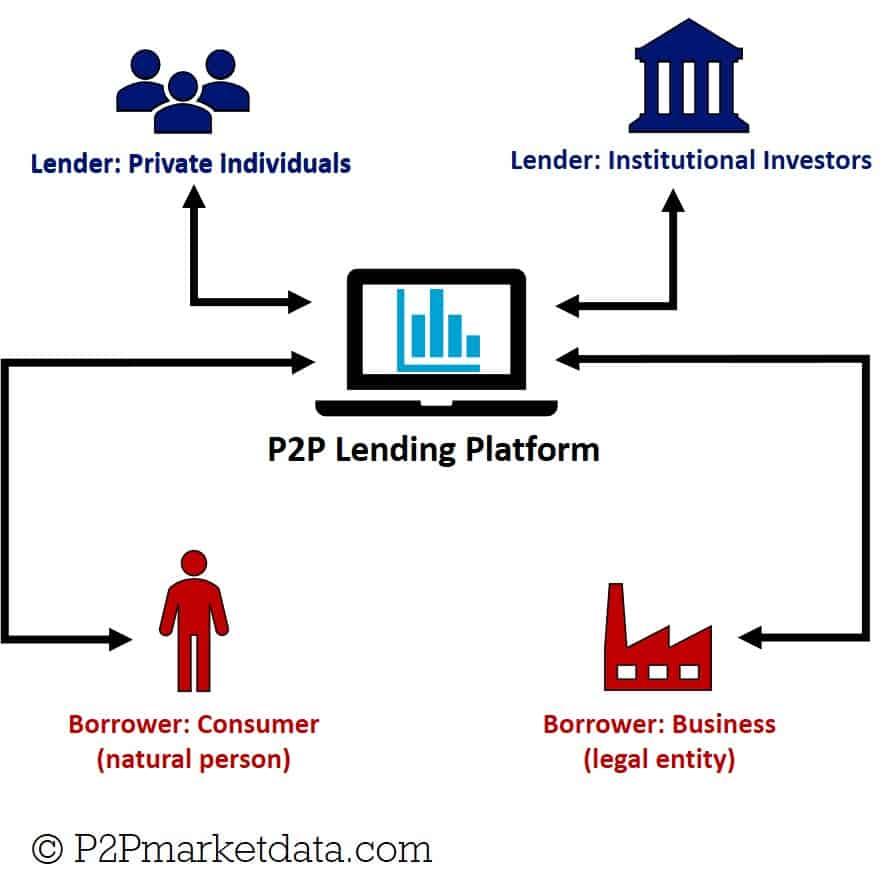

Lending Platforms: How to Generate Passive Income with Loans

Investing in loans through lending platforms can be a smart way to bolster your passive income portfolio. These platforms connect borrowers with lenders, allowing individuals to earn interest on their loans, much like a bank would. By carefully selecting the right loans, you can manage risk while enjoying lucrative returns. Here are a few benefits of using lending platforms:

- Diverse Investment Opportunities: Choose from personal loans,business loans,and even student loans to match your investment strategy.

- Automated Investing: many platforms offer auto-invest features that allow your funds to be allocated automatically across various loans with minimal effort.

- Clarity: Most lending platforms provide detailed borrower profiles and loan facts,giving you insights to make informed decisions.

To get started, it’s essential to do your research and select a reputable platform.Highly rated platforms often have various loan options with different risk levels and potential returns.Consider establishing clear criteria for your investments, such as:

- Minimum credit score: Filter loans by the borrower’s creditworthiness.

- Loan purpose: Decide whether you prefer to support personal loans, business ventures, or debt consolidation.

- Investment term: Choose loans with a term length that aligns with your financial goals.

To give you a better understanding of potential returns, here’s a comparison of various loan types and their typical interest rates:

| Loan Type | average Interest Rate | Risk Level |

|---|---|---|

| Personal Loans | 10% – 15% | Moderate |

| Business Loans | 8% – 20% | High |

| Student Loans | 4% – 8% | Low |

Harnessing the Power of Crypto Savings Accounts for Consistent Growth

Crypto savings accounts are revolutionizing the way investors grow their digital assets. These accounts typically offer higher interest rates compared to traditional savings accounts, allowing individuals to earn a steady yield on their cryptocurrency holdings. By simply depositing their coins, investors can benefit from not just potential price appreciation, but also from the interest accrued over time. This dual advantage makes crypto savings accounts an attractive option for those looking to maximize their returns in the volatile crypto market.

One of the key benefits of crypto savings accounts is their flexibility. Unlike fixed deposits in traditional banks, many of these accounts allow users to withdraw their funds at any time, providing liquidity without sacrificing growth. As investors continue to explore the digital finance landscape, they can tap into varying interest rates offered by different platforms, optimizing their earnings. Here are some popular features to consider when choosing a crypto savings account:

- Compounding Interest: Returns that increase your principal over time.

- Low Minimum Deposits: Convenient for both small and large investors.

- Multiple Cryptocurrency Support: Options to deposit various cryptocurrencies.

To illustrate the potential of crypto savings accounts, consider the following table, which compares the average annual interest rates across popular platforms:

| Platform | Annual Interest Rate | minimum Deposit |

|---|---|---|

| Platform A | 8% | $100 |

| platform B | 6% | $50 |

| platform C | 10% | $200 |

With varying rates and features, investors are encouraged to explore and compare options before committing their funds. along with the competitive returns,many platforms emphasize security measures,including cold storage and insurance policies,to safeguard users’ assets.By leveraging crypto savings accounts wisely, individuals can cultivate a consistent stream of passive income, enhancing their financial portfolio in the evolving digital economy.

Q&A

Q&A: Exploring Passive Income Ideas with Crypto Investments

Q: What is passive income in the context of cryptocurrency?

A: Passive income in cryptocurrency refers to earning money with minimal active involvement. Unlike trading, where you constantly buy and sell assets, passive income strategies allow you to generate returns on your investment while you go about your daily life. Think of it as earning “crypto dividends” or interest from your assets, frequently enough facilitated by various platforms and decentralized finance (DeFi) solutions.

Q: What are some popular methods to generate passive income through crypto?

A: There are several intriguing methods to consider, including:

- Staking: Many cryptocurrencies, such as Ethereum 2.0 and Cardano, offer staking options.By holding and “staking” your coins,you can earn rewards in the form of additional tokens.

- Yield Farming: This decentralized finance (DeFi) strategy involves lending your cryptocurrency to others and receiving a portion of the interest they pay. While it can be complex, the returns can be significant.

- Crypto Savings Accounts: Just like a traditional savings account, some platforms allow you to deposit your crypto and earn interest. Rates can vary widely, so it’s essential to shop around.

- liquidity Pools: By providing liquidity to decentralized exchanges,you contribute to the trading of tokens and,in return,earn transaction fees.

Q: What are the risks associated with these passive income strategies?

A: As exciting as passive crypto income can be, it’s not without risks. The volatility of cryptocurrency prices can lead to significant losses. Additionally:

- Staking: If the network you’re staking on faces issues or if there’s a sudden drop in token value, your investment may decrease in value.

- yield Farming: This method frequently enough involves impermanent loss, where fluctuations in token prices can affect the value of your staked assets.

- Crypto Savings Accounts: The interest rates might be attractive, but the platforms can be unregulated, posing risks of platform failure or hacks.

Q: How can someone get started with passive income in crypto?

A: Getting started requires a few key steps:

- Educate Yourself: Understand the basics of cryptocurrency and the specific investment methods.

- Choose a Crypto Wallet: Secure your digital assets using a reputable wallet, either a software or hardware wallet, based on your investment size and goals.

- Research Platforms: Investigate platforms that offer staking, yield farming, or savings accounts. Ensure they have a good reputation and security measures in place.

- Start Small: Begin with a small investment to understand the mechanics before committing more significant amounts.

- Monitor Your Investments: While the goal is passive income, it’s critically important to periodically check on your investments and stay informed about market trends.

Q: Are there tax implications for earning passive income through crypto?

A: Yes, in many jurisdictions, crypto earnings—whether from staking, yield farming, or interest—are typically subject to capital gains taxes or income taxes. It’s crucial to consult with a tax professional familiar with cryptocurrency regulations in your area to ensure proper compliance and reporting.

Q: What’s the future of passive income in crypto?

A: the future of passive income in crypto is likely to grow, as the defi ecosystem continues to expand and introduce innovative financial solutions. With blockchain technology maturing, we may see even more accessible and safer options. Though, as with all investments, staying informed and cautious will be essential to navigate this evolving landscape successfully.

As you explore the world of passive income through cryptocurrency, remember that while the prospects can be enticing, thorough research, risk assessment, and strategic planning are key to effective participation in this digital frontier. Happy investing!

Key Takeaways

the world of cryptocurrency provides a myriad of opportunities for generating passive income, catering to both seasoned investors and curious newcomers alike. By delving into strategies such as staking,yield farming,and lending,individuals can tap into the evolving landscape of digital assets to create a steady stream of returns. As with any investment, it’s essential to approach these opportunities with a solid understanding of the associated risks and a commitment to ongoing education. The key to success in passive income through crypto lies not just in the choices you make, but in your willingness to adapt and grow alongside this dynamic market. So, whether you’re looking to diversify your income sources or embark on a new financial journey, let the ideas presented here ignite your inspiration, guiding you towards a future where your efforts yield fruitful rewards. Happy investing!